Freeports, like free lunches, might come with strings attached

Freeports are in the news again after the government unveiled plans to create up to ten of them across the UK after Brexit. Freeports are designated areas within the geographic boundary of a country that are subject to simplified customs procedures on imports. Firms importing goods into them can typically defer duties until the goods enter free circulation or are used within the freeport area

Freeports are in the news again after the government unveiled plans to create up to ten of them across the UK after Brexit.

Freeports are designated areas within the geographic boundary of a country that are subject to simplified customs procedures on imports. Firms importing goods into them can typically defer duties until the goods enter free circulation or are used within the freeport area. The UK used to have seven of them up until 2012, when the legislation establishing them was not renewed. Could the reintroduction of freeports, which are allowed under EU rules, help us to limit post-Brexit trade frictions and revive local communities?

The first question to address is about the potential tariff gains. In the world where the tariffs are generally low the scope for this benefit is quite limited: most trade costs are generated by non-tariff barriers, that is the need to comply with the rules and regulations of the EU and other markets. However, thanks to their special customs procedures freeports can be beneficial for producers who face so-called inverted tariffs, that is higher import duties on the intermediate parts than on the final goods. In that sense it could be beneficial to import some components into a special customs territory to defer the customs payment, process the parts and ultimately clear for free circulation the final good. That said, the EU tends to have lower tariffs for intermediates than for final goods, therefore the scope for real benefits here is also limited. As highlighted in a recent paper by Peter Holmes and Ilona Serwicka, the UK sectors exhibiting the highest tariff wedge between tariffs on intermediate and final goods account for only a small fraction of the total UK imports. For instance, the ‘manufacture of starches and starch products’ (ISIC4 1062) with the highest tariff wedge of 27% constitutes some 0.2% of total UK imports.

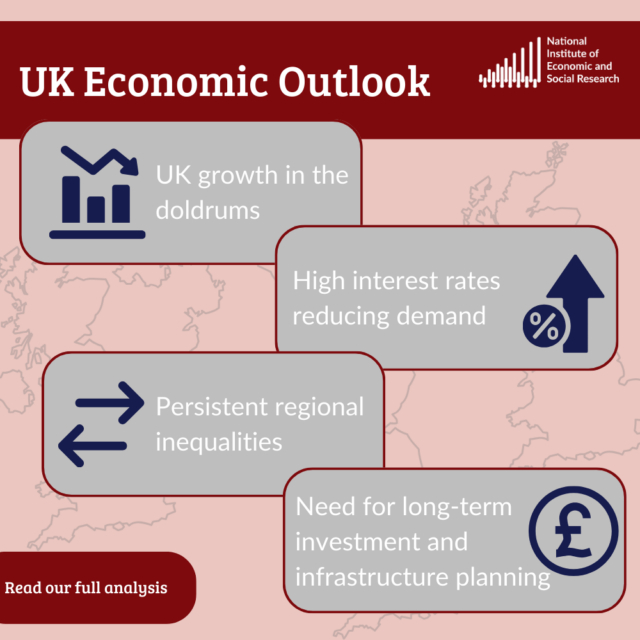

Another question is about the potential of the freeports to spur new economic activity and regional development. By design, freeports or free economic zones would offer a special treatment to a subset of companies located within a specified area. This means that the conditions for their competitors could tighten: competing firms could be faced with trade-off between relocating production to the special zone (which might be easier said than done) and facing ‘unfair’ competition due to more favourable conditions for firms operating in the zone. This distorts the level playing field and, maybe more importantly, leads to the question whether free ports would incentivise the new investment or whether they would just lead to the relocation of economic activity that would have happened anyway.

In conclusion, while it is certainly desirable to see policy and budgets allocated for no-deal preparations, we need to ensure that this effort is correctly targeted. And this would certainly require going down to the details of the freeports policy implementation plan, such as a careful choice of location sites, complementary infrastructure investments or the realistic assessment of the time needed for them to become fully operational. Moreover, crucially, if freeports are advertised as a force for the rebalancing of the UK economy, they will not and cannot replace the long-term policy agenda that should address the root causes of regional disparities, as my colleague David Nguyen has pointed out. At best, freeports can be a part of the policy menu but they are certainly not the main course.