The Bank Capital-Competition-Risk Nexus – A Global Perspective

Pub. Date

Pub. Date

Pub. Type

Pub. Type

The Global Financial Crisis (GFC) highlighted the importance of a number of unresolved empirical issues in the field of financial stability. First, there is the sign of the relationship between bank competition and financial stability. Second, there is the relation of capital adequacy of banks to risk. Third, the introduction of a leverage ratio in Basel III following the crisis leaves open the question of its effectiveness relative to the risk adjusted capital ratio (RAR). Fourth, there is the issue of the relative stability of advanced versus emerging market financial systems, and whether similar factors lead to risk, which may have implications for appropriate regulation. Finally, there is the nature of the relation between bank competition and bank capital. In this context, we address these five issues via estimates for the relation between capital adequacy, bank competition and other control variables and aggregate bank risk. We undertake this for different country groups and time periods, using macro data from the World Bank’s Global Financial Development Database over 1999-2015 for up to 120 countries globally, using single equation logit and GMM estimation techniques and panel VAR. This is an overall approach that to our knowledge is new to the literature.

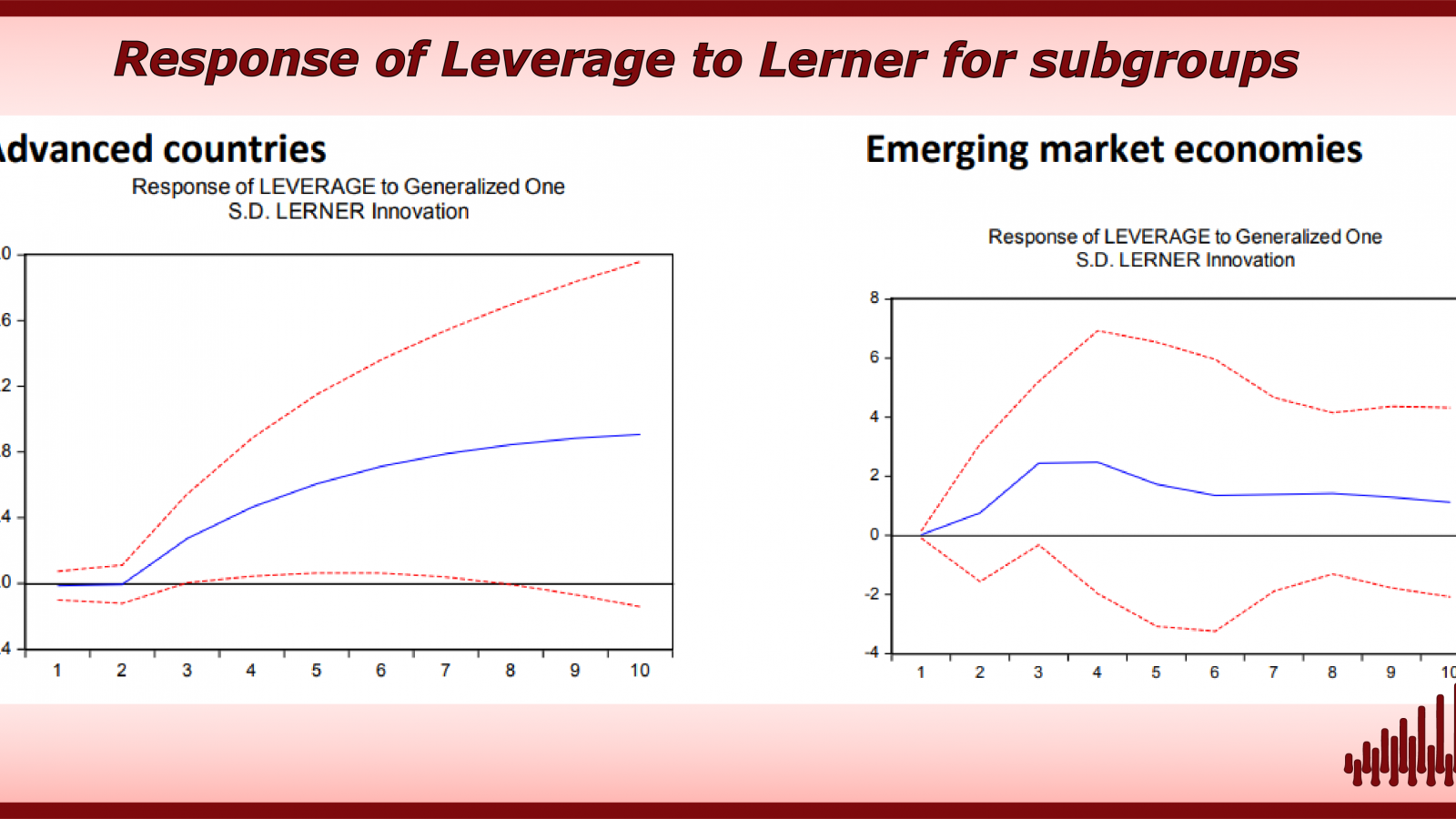

The results cast light on each of the issues outlined above, with important implications for regulation: (1) The results for the Lerner Index largely underpin the “competition-fragility” hypothesis of a positive relation of competition to risk rather than “competition stability” (a negative relation) and show a widespread impact of competition on risk generally. (2) There is a tendency for both the leverage ratio and the RAR to be significant predictors of risk, and for crises and Z score they are supportive of the “skin in the game” hypothesis of a negative relation between capital ratios and risk, whereas for provisions and NPLs they are consistent with the “regulatory hypothesis” of a positive relation of capital adequacy to risk. (3) The leverage ratio is much more widely relevant than the RAR, underlining its importance as a regulatory tool. The relative ineffectiveness of risk adjusted measures may relate to untruthful or inaccurate assessments of bank real risk exposure. (4) There are marked differences between advanced countries and EMEs in the capital-risk-competition nexus, with for example a wider impact of competition in EMEs (although both types of country need to pay careful attention to the evolution of competition in macroprudential surveillance). Similar pattern to EMEs are apparent in many cases for the global sample pre crisis, which arguably are more consistent with normal market functioning than post crisis. (5) Competition reduces leverage ratios significantly in a Panel VAR, with impulse responses showing that more competition leads to lower leverage ratios and vice versa. This result is consistent over a range of subsamples and risk variables. In the variance decomposition, we find that competition is autonomous, while the variance of both risk and capital ratios are strongly affected by competition. The Panel VAR results give some indication of the transmission mechanism from competition to risk and financial instability.