Brexit forecasters: How did they perform?

Economic forecasts were roundly criticised for exaggerating the fallout from the EU referendum last year. As it turned out, the economy did outperform many forecasts in the period that immediately followed the referendum, but that has changed quite markedly this year as household incomes are squeezed by high inflation and economic growth has consequently slowed. Was the criticism fair?

Economic forecasts were roundly criticised for exaggerating the fallout from the EU referendum last year. As it turned out, the economy did outperform many forecasts in the period that immediately followed the referendum, but that has changed quite markedly this year as household incomes are squeezed by high inflation and economic growth has consequently slowed. Was the criticism fair?

Figure 1 shows the evolution of consensus GDP growth for 2017 from just before the referendum in June last year to the most recent reading in July this year. The figure clearly shows that GDP growth in the Euro Area and the UK have diverged – the outlook for Euro Area growth has been revised higher, whereas the outlook for the UK has turned lower. The same figure also shows that the slowdown in UK output growth was gradual, down from 2.2 per cent in 2015 to 1.8 in 2016 and, if consensus expectations for 2017 prove to be accurate, the economy will expand by 1.6 per cent this year. Among the many factors that have influenced the UK and Euro Area GDP growth over the past year, the prospect of the UK exiting the EU is likely to have been an important one.

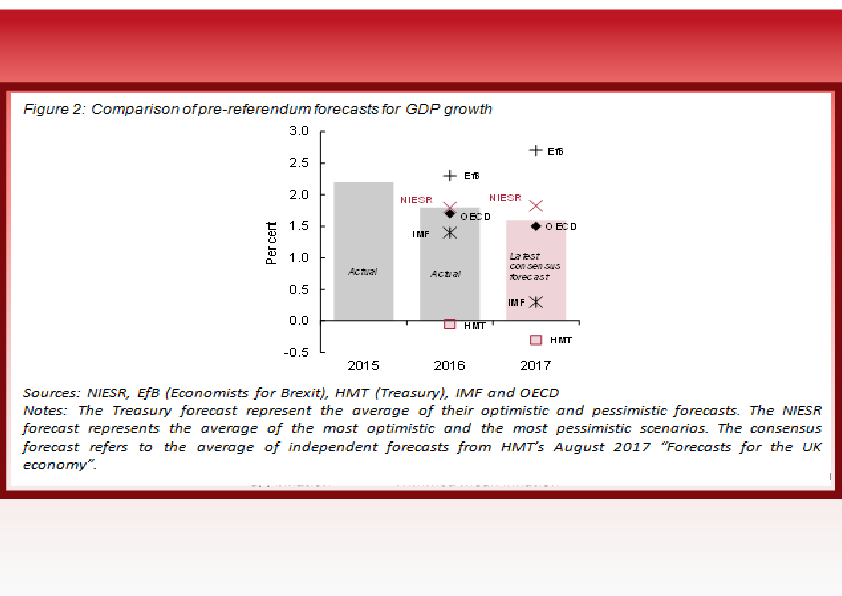

How did the major forecasters perform for the UK? Figure 2 shows a selection of Brexit scenario forecasts by Economists for Brexit, IMF, NIESR and OECD that were published ahead of the referendum. We have actual GDP growth data for 2016, and for 2017 we benchmark the Brexit forecast against the latest consensus forecast. All forecasters, with the exception of the ‘Economists for Brexit’, rightly envisaged that the economy will slow. The ‘Economists for Brexit’ were sat at the extreme end of optimism looking for economic growth to accelerate in 2016 and again this year. By contrast, HM Treasury forecast a drop in output this year and next year. The figure also highlights that the GDP growth forecasts published by OECD and NIESR were relatively accurate, underscoring the importance for relying on central forecasts rather than those at the extreme end of the spectrum.

What went right and what went wrong? The NIESR forecast captured the broad dynamics, but there were misses too. Perhaps the most important related exchange rate pass-through. Most forecasters accurately predicted the 10 per cent depreciation of sterling compared to its main partners’ currencies after the referendum, but different assumptions on the speed and scale of pass-through into import and consumer prices produced more volatile inflation forecasts. As can be seen in Figure 3, inflation was lower than predicted by any of the forecasters in our sample in 2016, but higher in 2017 for most forecasters. Naturally, Brexit-driven exchange rate passthrough was not the only explanation behind the recent rise in inflation, but it was a key differentiating factor among forecasts.

Despite the shock from the referendum result, consumption and private sector investments have surprised on the upside. In 2016, consumption grew by 2.8 per cent, which was the fastest pace since 2007. For the year 2017, NIESR had to revise its pre-referendum forecast for consumption growth from 1.2 per cent to 1.5 per cent and for private sector investment contraction from 5.1 per cent to 3.3 per cent.

As consumers’ real disposable incomes have been squeezed by surging inflation, the stronger-than-expected consumption can be explained by a fall in the savings ratio. Indeed, the savings ratio fell to 1.7 per cent of disposable income in the first quarter, which is the lowest point since at least 1963. In the external sector, the rebalancing of the current account looks likely to take longer than expected. Both exports and imports are now forecast to grow in 2017, respectively, at 1.8 and 0.2 per cent in NIESR’s current forecast, compared to a pre-Brexit forecast of 1.2 and –3.9 per cent respectively. The surprise resilience of imports in particular can be explained by the upside surprise in domestic demand expounded above. All in all, the negative contribution of higher imports compensates for the positive contributions of higher consumption and investment to make NIESR’s headline GDP forecast reasonably accurate.