Marking myself to market: my predictions for 2013, revisited

Brad Delong calls for economists to “mark their beliefs to market” – that is, reassess their position when the facts suggest that they might have been wrong – and commendably shows us the way here.

Brad Delong calls for economists to “mark their beliefs to market” – that is, reassess their position when the facts suggest that they might have been wrong – and commendably shows us the way here. He is also very hard on economists who fail to do so. Last year at this time I re-evaluated my FT predictions for 2012, made in December 2011. So now it’s time to do the same for this year’s predictions, made in December 2012.

The one that most people will focus on is that for UK economic growth. The forward-looking part of my answer said:

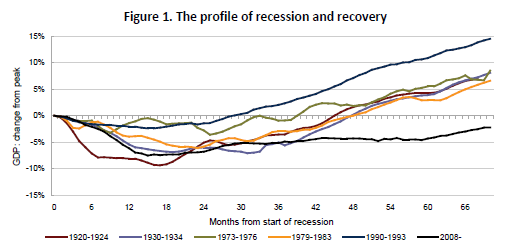

This period of depressed output is now significantly longer than that experienced during the Great Depression, and is not likely to end any time soon; we do not expect output to pass its early 2008 peak until 2014 at the earliest. We don’t predict growth significantly above potential – a necessary condition for a sustained recovery and a meaningful fall in unemployment back towards the natural rate – until perhaps 2015.

The first sentence was accurate, of course. Output remains more than 2 percent below its 2008 peak. It may rise above it at some point in mid-2014.

The second was not: we have now had two quarters of growth somewhat above potential, and are seeing a meaningful fall in unemployment, although it remains well above its natural rate. I explained here what I think are the main drivers of recovery:

The fiscal squeeze has been relaxed, at least temporarily, while a number of government schemes are boosting the housing market. Meanwhile the external environment is much more benign than a year ago: the eurozone crisis is, if not solved, at least on hold, and the US economy has been recovering for some time. Poor policy and bad luck has delayed recovery, relative to our original forecasts and everyone else’s, but has not removed the ability of the UK economy to generate growth.

I won’t bother to address here the sillier claims that recovery has somehow vindicated the government’s misguided decision to go for premature fiscal consolidation, which don’t even add up on their own terms. As Simon Wren-Lewis says, this is not a remotely serious argument, and it says more about the people who make it than about the UK economy. But it is reasonable to ask why did I (and NIESR’s forecasts, and that of most mainstream macroeconomic forecasters) not predict the strength of recovery?

Duncan Weldon has a go at this here. His main point is that thanks to unconventional monetary policy (especially the modified Funding for Lending Scheme and – now Help to Buy) households are spending again, despite real incomes continuing to stagnate. He notes that a year ago he had raised this possibility (although it wasn’t his central scenario).

It is possible that we still get weak income growth but that the savings ratio drops rapidly. In this scenario we’d see faster consumption growth and hence faster overall growth. This however would be accompanied by a big increase in household debt. It might give us 3 – 4 years of decent growth, but at the risk of increasing the financial imbalances that got us into trouble in the first place.

There is clearly something to this, but I don’t entirely agree, or at least it’s not the whole story. I think that the main reason is simply that forecasters are not very good at turning points or sharp changes. NIESR, like most other forecasters, had been predicting for more than 2 years that recovery would begin in 6 months or so. Once that prediction finally materialised, it was always likely that, given the amount of spare capacity, that it would be relatively quick. Indeed, I’d point to an answer I gave two years ago, which seems (finally) to have materialised:

In an optimistic scenario we’d be well over the worst of the economic downturn, and although it won’t be plain sailing, beginning to see concrete signs of improvement. With – see above – an economy that is in underlying reasonable health, we should be looking forward to reasonably strong growth, perhaps better than the current forecasts. With President Obama reelected on the back of a solid recovery in the US, and the eurozone with finally a coherent if not comfortable approach to its problems, there is a reasonable degree of economic policy coordination and a generally much better international atmosphere. We might even start thinking about what to do about the real long-term problems for the developed world – unacceptable levels of inequality, and how to make the financial sector serve the real economy rather than extract rents from it for the benefit of a very few.

One big question now for the short to medium term is whether growth higher than trend can be sustained for any length of time without running into supply constraints, and hence higher inflation. A period of sustained above trend growth, making up some of the lost ground of the last 6 years, will of course be a vindication of those of us who argued that the UK economy was in relatively good shape pre-crisis, and that much of the pain of recent years has been unnecessary. Here I’ve always been on the side of the optimists – see my bet with Andrew Lilico.