The Textbook Response: using Chinese Fiscal Policy to offset US Tariffs

The stimulus policies introduced by China and other countries will more than offset the trade shock imposed by the US and as such a successful conclusion of the US –China trade talks that reverses current tariffs presents an upside risk to our GDP growth forecast.

The stimulus policies introduced by China and other countries will more than offset the trade shock imposed by the US and as such a successful conclusion of the US –China trade talks that reverses current tariffs presents an upside risk to our GDP growth forecast.

In our latest forecast we argue that the global economy will recover from what we believe was a soft patch in the second half of last year. The most recent economic data from the Euro Area, US and China suggests that the global economy is in fact staging a recovery in the first quarter of this year. It is also our view that policy actions contributed to the slowdown last year and that the recovery that is built into our forecasts this year is also driven by policy.

On our calculations, global growth eased from a quarterly pace of around 1 per cent in the first half of last year to around 0.6 per cent in the second. The weakness in the second half of last year was primarily related to industrial production and international trade and is likely to be a consequence of the trade dispute between the US and other countries, but mainly with China. Tighter monetary policy and widening credit spreads also contributed to the slowdown.

We focus on trade barriers and use NIESR’s Global Econometric Model (NiGEM) to quantify the impact of a trade shock on global GDP growth. We run two sets of simulations. In the first set, we apply 10 per cent import duty on $200bn imports of Chinese goods in to the USA and $60bn worth of Chinese imports from the US. This is broadly in line with the tariffs announced by the US in September last year and the Chinese retaliation. This is roughly where things stand today between China and the US.

In the second set, we raise the tariff to 25 per cent from 10 per cent. The US has threatened to raise tariffs to this level if trade negotiations fail.

Figure 1: Average impact on the level of GDP (over three years)

The impact of these two sets of simulations on GDP (level) is shown in Figure 1. Our results suggest that the peak impact on World GDP will be in the region of 0.1-0.2 compared to a baseline scenario without the tariffs. The Chinese economy is most vulnerable with GDP impact of somewhere between 0.3-0.6 per cent and the impact on US GDP is likely to be around 0.1-0.3 per cent.

The slowdown in activity last year triggered a series of policy responses in 2018 and 2019. These include U-turns by central banks in developed and emerging economies to outright stimulus by the Chinese government. Within the emerging world, the People’s Bank of China (PBOC) lowered the required reserve ratio in steps and the Reserve Bank of India injected stimulus into the economy with reductions in its benchmark policy rate. Following on from that, the ECB and the Federal Reserve signalled a delay in policy tightening.

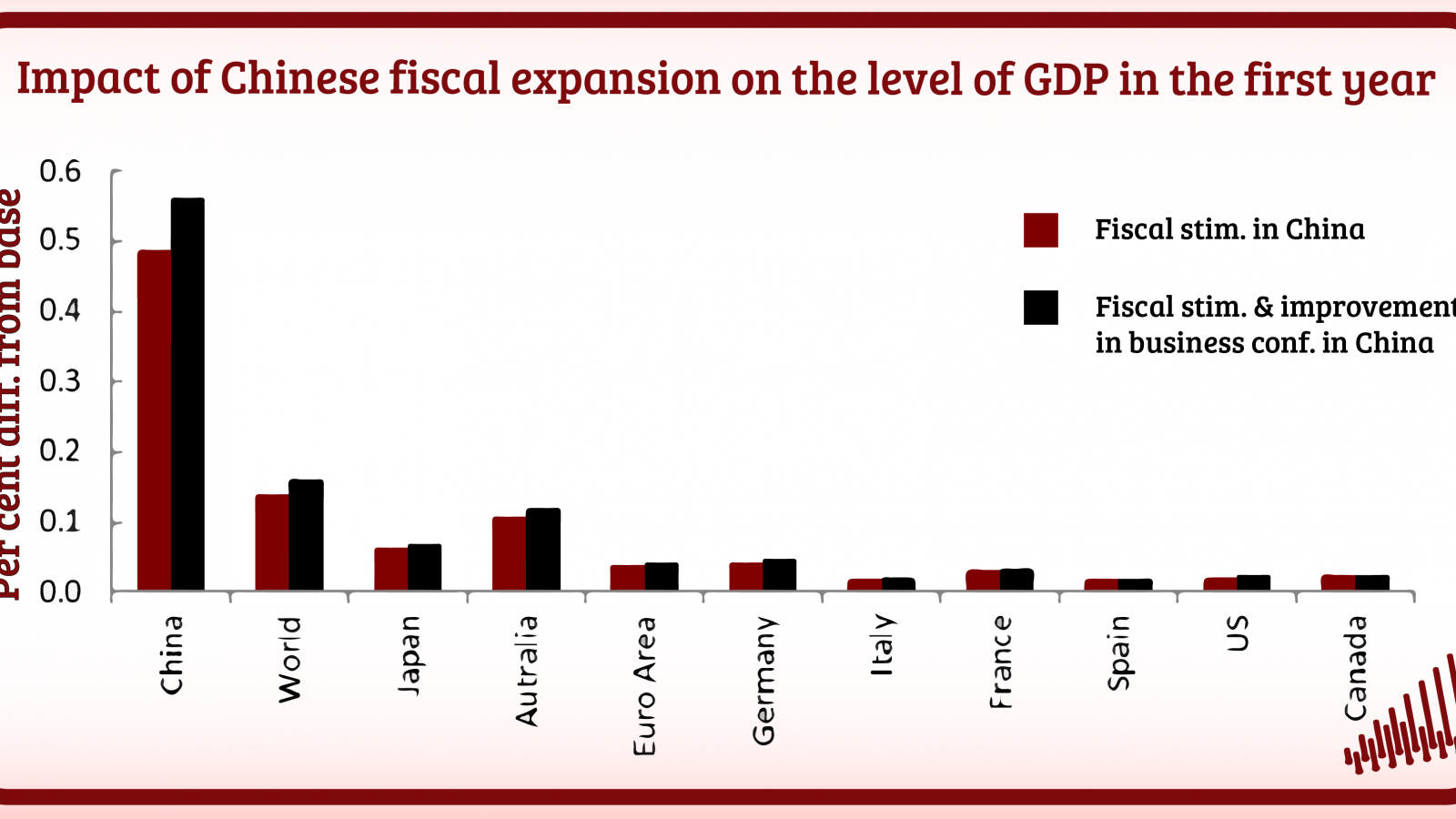

Central banks aside, the China government announced a set of stimulus measures (worth around 2 trillion yuan or 2.2 per cent of GDP) in March this year covering taxes (reduction in VAT and personal taxes) and employers’ social security contributions. We use NiGEM to run a set of stylised scenarios to investigate the impact of the fiscal package (alone as well as coupled with a reduction in investment premia) on output in the first year.

We conduct two sets of simulations: first with simply the aforementioned cuts in taxes; second, the fiscal stimulus is augmented to take into account more freely available credit (via a reduction in investment premia) for private business in China. This could result from the reduction in the reserve ratio announced by PBOC discussed above.

Figure 2: Impact on GDP level in the first year

Figure 2 illustrates the estimated impact on the level of Chinese GDP (relative to baseline), for selected advanced economies and the world as a whole for both scenarios. Our results suggest that the fiscal stimulus alone will lift output in China by about 0.5 per cent. That, together with the reduction in investment premium will raise the level of Chinese GDP by 0.6 per cent, likely offsetting the anticipated negative impact from the higher 25 per cent tariff rate and more than offset the impact of the current level of tariffs which stands at 10 per cent.

To be sure, the trade barriers and fiscal expansion are different types of shocks. The trade shock is a negative supply shock that will have the effect of lowering output and raising prices, whereas the fiscal and monetary expansion discussed above are examples of demand shocks, causing both prices and output moving in the same direction – higher. Our simulation results suggest that the positive impact of the fiscal expansion on Chinese GDP will broadly offset the negative impact on Chinese output from the trade shock. Both policy actions will however, drive prices higher.

Looking ahead, the US and the Chinese governments are currently engaged in trade negotiations. News reports suggest that the discussions are progressing well and as a result, most commentators expect that an escalation is unlikely. If indeed talks succeed, there is a possibility of both sides reversing the current 10 per cent tariff rate that were introduced last September. A reversal of the 10 per cent tariffs would boost Chinese GDP around 0.3% and as such that presents an upside risk to our GDP forecast for China and the World unless of course, policy makers decide to reverse some of the stimulus measures.