Time for the Bank to Walk the Walk

Lockdown ended on 19 July; the furlough will end on 30 September. The economy is set to reach its pre-pandemic activity level, but the Bank of England’s extreme monetary accommodation appears to go on forever. It is past time for the Bank to act to bolster its credibility and to act to avoid un-anchoring inflation expectations.

Lockdown ended on 19 July; the furlough will end on 30 September. The economy is set to reach its pre-pandemic activity level, but the Bank of England’s extreme monetary accommodation appears to go on forever. It is past time for the Bank to act to bolster its credibility and to act to avoid un-anchoring inflation expectations.

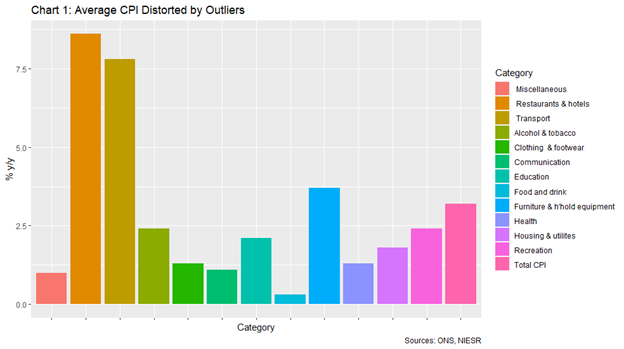

The Bank of England’s Monetary Policy Committee has put itself in an unenviable position. Its monetary policy has become reactive rather than proactive and is now behind the curve. Inflation keeps surprising on the upside, as we saw in August’s shocking 3.2% y/y reading. The Bank hopes that high inflation in a couple of categories will decline, reducing inflation to 2% (see charts). However, VAT base effects will push inflation higher, and raising National Insurance rates will boost costs and prices in the months ahead. Thus, headline inflation could peak at nearly 5% early next year, with the overshot of the 2% target lasting two years. This sustained surge risks raising inflation expectations.

The writing has been on the wall for months that inflation would rise significantly. With widespread reports of capacity and labour shortages, the Bank’s forecasts appear tainted by wishful thinking and a near-theological belief in the gravitational pull of the 2% inflation target. Ample evidence of shortages, including in labour markets, and a comparable experience in the US, where earlier opening-up than in the UK led to higher inflation, should have hoisted warning flags. However, the Bank has set policy according to optimistic projections of inflation: it has been anything but forward-looking as its low projections depend on anchored inflation expectations that are themselves determined by history rather than hope.

The MPC might claim that risk management is the reason for adopting this strategy, but the Bank’s main management achievement has been to escalate inflation risks. It also substantially increased medium-term downside risks to activity because if the genie of inflation expectations escapes the bottle, it will take forceful action to put it back in again. Inflation in recent years has in many countries been unresponsive to conventional measures of economic slack. Thus, if we end up in a self-reinforcing circle of higher inflation expectations feeding into prices and wages, controlling it could require a sharp shock to the system – abruptly higher rates and a recessionary contraction in demand.

The Bank’s projections rely on inflation expectations remaining anchored to its inflation target, but Covid reduced the chances of that by shocking prices and increasing uncertainty. Central bank models assume that economic agents behave consistently with the inflation target. A central bank’s credibility over its ability and willingness to hit the target does most of the heavy lifting in stabilising inflation, reducing the required interest rate response to economic shocks. There are two fundamental flaws with relying on the Bank of England’s credibility to hit its target. The first is assuming credibility is unchanged. If central bank actions are forward-looking, economic agents expect central bankers to set policy consistent with their forecasts. Poor forecasts, such as this year, imply poor policy, damaging credibility.

Moreover, credibility is vulnerable to concerns that the Bank may be concerned that higher rates could sharply reduce the value of its massive QE bond holdings, covered only by an untransparent Treasury indemnity.

The second flaw arises because Covid increases uncertainty, including about inflation. Inflation expectations likely become more adaptive when uncertainty rises, increasing the sensitivity to actual inflation and significantly lowering the weight of the inflation target. What matters more for inflation expectations today is less what the Bank of England says will happen but today’s reality. When inflation expectations become more adaptive, “transitory” shocks can mutate into longer-lasting higher inflation with a high output cost of elimination. That is the risk we face now.

The MPC’s lack of action so far reveals a hope that the public will trust it to do the right thing in the future and that, therefore, inflation expectations will remain well controlled. This naïve hope is inadequate in the face of increased inflation uncertainty and significant forecasting errors. The Bank needs to reinforce its credibility and act in a manner consistent with lowering inflation. There is no need to panic: core inflation is more moderate than the headline rate. However, anchoring inflation expectations, which respond to the headline rate, requires strong signals, showing the Bank is willing to walk rather than just talk. The Bank’s asset purchases need to end, and interest rates should soon return, as a first step, to pre-Covid levels. Undue delay, against the background of rising wages and high inflation, will give the wrong signal about the Bank’s willingness to control inflation, leading to more significant problems down the track.