Why the Chancellor will not meet the fiscal mandate

Last week, Chancellor Sajid Javid announced a fast-tracked one-year spending round to pin down expenditure limits for government departments in the 2020-21 fiscal year. According to his announcements, the round will account for spending commitments made by the Prime Minister since he came to office while continuing “to keep borrowing under control and debt falling by meeting the existing fiscal rules”

Last week, Chancellor Sajid Javid announced a fast-tracked one-year spending round to pin down expenditure limits for government departments in the 2020-21 fiscal year. According to his announcements, the round will account for spending commitments made by the Prime Minister since he came to office while continuing “to keep borrowing under control and debt falling by meeting the existing fiscal rules”. In this blog, we explain why these objectives taken together are incompatible. Operating within the previous government’s fiscal rules would be entirely unachievable should the United Kingdom exit the European Union without a deal at the end of October.

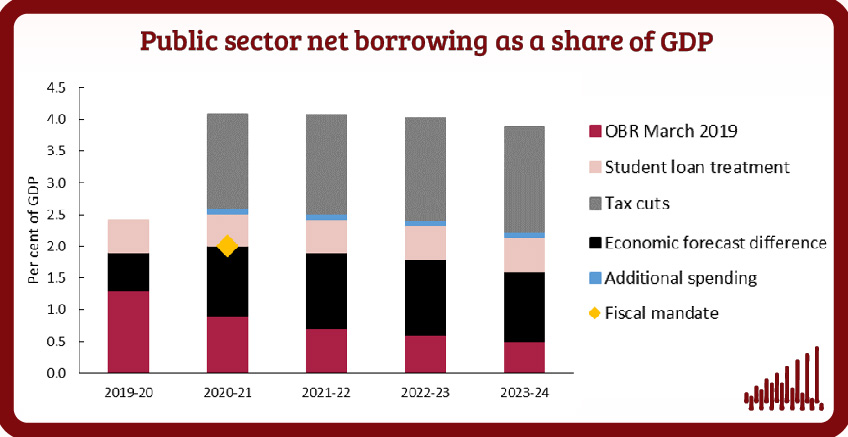

Current fiscal rules require public sector net borrowing, adjusted for the business cycle, to lie below 2 per cent of GDP in the next financial year (2020-21), the so-called ‘fiscal mandate’. In March, the Office for Budget Responsibility forecast that borrowing as a share of GDP would fall to 0.8 per cent in that year, providing the government with a headroom of 1.2 per cent of GDP, or £27 billion, the former Chancellor’s famous ‘war chest’.

The OBR’s March borrowing forecast is depicted in figure 1 (red bars). It was based on an outlook for economic growth of 1.2 per cent in 2019 and 1.4 per cent in 2020. Since spring, the growth outlook has deteriorated, with GDP contracting by 0.2 per cent on a quarterly basis in the three months to June. NIESR’s GDP Tracker suggests that output will expand by only 0.2 per cent in the third quarter of 2019 as global weakness and Brexit weigh on activity. A high degree uncertainty around these numbers means that there is around a 30 per cent probability that the economy entered a technical recession in April, i.e. two consecutive quarters of falling output. On our forecast, a weaker economy throughout next year would mean that borrowing as a share of GDP could end up more than 1 per cent higher than expected by the OBR in spring (black bars). Even with spending plans unchanged this would eliminate all available headroom against the fiscal mandate (yellow diamond).

A further challenge the Chancellor faces is a new treatment of student loans in the national accounts which the Office for National Statistics estimate would add another ½ percentage point of GDP to headline deficit figures without affecting actual money flows (pink bars).

The Institute for Fiscal Studies estimates that the Prime Minister’s promises to spend more on education and the recruitment of 20,000 police officers would cost £2 billion a year (0.1 per cent of GDP, blue bars); and since the Chancellor’s spending round announcement another £2.5 billion has been promised for extra prison places. One could extend the list of items adding to public borrowing with announcements made during the Conservative leadership campaign to include lower corporate and income tax rates and national insurance contributions which, on our estimates (link, see Box C), would add another 1½ percentage points to the deficit ratio (£35 billion a year, grey bars).

But risks to the government’s fiscal position do not stop there. Quite the contrary. The OBR’s economic and fiscal outlook in spring was based on the assumption of an orderly exit from the European Union and a transition period until the end of 2020. The new government’s ‘do or die’ strategy means that the risk of a no-deal exit has increased, to more than 40 per cent according to current odds on betting markets.

A no-deal Brexit would weaken the British economy even further; for 2020 as a whole, we forecast zero economic growth in such an event. A significantly weaker economy would mean HM Treasury loses substantial amounts of tax revenue, and will have to spend more on unemployment and other benefits. Recovering current net fiscal contributions to the EU budget (and reduced spending on a potentially smaller population if EU migration is inhibited) will be far from sufficient to make up for these revenue losses (figure 2). This means that borrowing would have to rise by at least another £20 billion a year (the OBR estimates an increase of £30 billion), equivalent to an additional 1 per cent of GDP.

Taking all these factors together – a weaker economy, accounting changes, tax and spending promises and the economic impact of a no-deal Brexit – suggests to us that the government’s spending round will violate current fiscal rules. While these rules exist for good political reasons, helping the Treasury to control departmental spending, they are far from economically optimal and have in the past been changed regularly as circumstances changed, the last time in 2017 under Chancellor Philip Hammond. A renewed overhaul appears more than likely as we will see official borrowing forecasts being revised up in the autumn. What was true with Brexit negotiations is also true in fiscal policy: it is not possible to have your cake and eat it.