Carbon tax could temporarily raise inflation and lower GDP in most OECD economies, NIESR study shows

A sudden and uniform rise of $100 per tonne in the carbon tax applied across all economies could drive inflation higher short term and lower GDP by about 1-2% in most OECD countries, and considerably more in more carbon intensive economies, according to a new study by The National Institute of Economic and Social Research.

Climate change policies such as carbon taxes and emissions trading schemes (ETSs) have become key policy tools to reduce greenhouse gas (GHG) emissions and limit global temperature increases. Using the National Institute Global Macroeconomic Model (NiGEM) we illustrate the expected macroeconomic fallout from a sharp and unexpected rise in the price of carbon. Main points include:

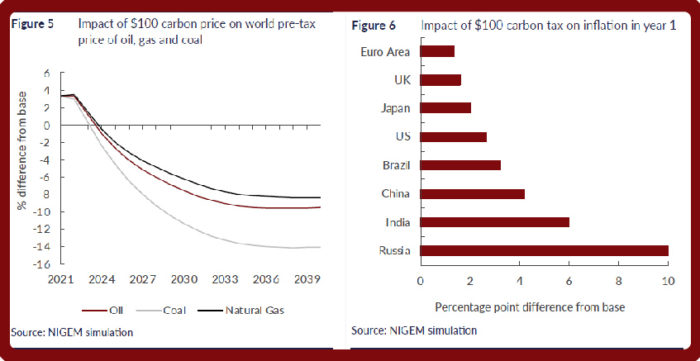

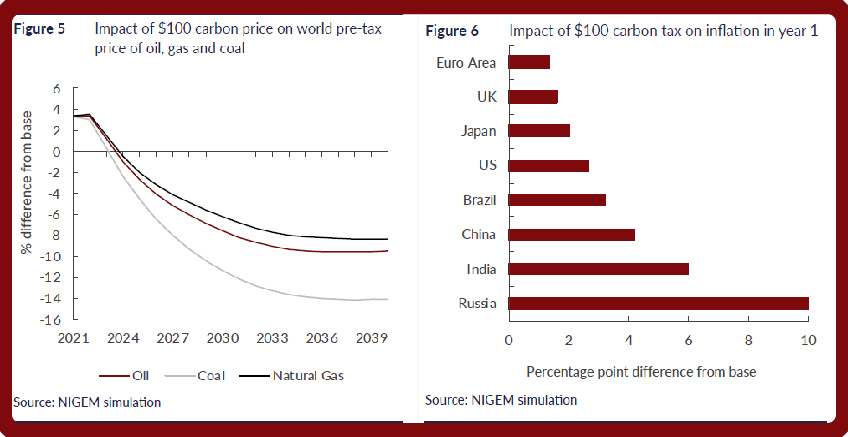

- A $100 per tonne rise in the carbon price would raise the price of coal by over 300 per cent relative to renewables. Carbon is currently trading at just over $60 per tonne, whereas estimates of the social cost of carbon tend to exceed $100 per tonne.

- Stress testing exercises by the Bank of England consider the potential for carbon prices to rise to over $1000 per tonne by 2050. A $100 carbon tax rise would be a significant shock to the world economy but falls well within the realms of potential scenarios

- Countries that continue to rely heavily on fossil fuel exports will suffer a significant loss in potential export revenue, stemming from both a decline in the volume of demand for fossil fuels and a decline in the value of each tonne of fossil fuel exported. This will

deliver significant terms of trade losses for fossil fuel exporters, acting as a constraint on GDP as income losses feed into lower levels of domestic demand - This acts as a fiscal tightening equivalent to 1-2 per cent of GDP in most OECD countries, and considerably more in more carbon intensive economies such as Russia, South Africa and India. If the revenue is channelled back into the economy via income tax cuts, this would offset some of the immediate impacts on GDP.

- A $100 carbon price rise would quadruple the post-tax price of coal relative to renewable energy. The prices of gas and oil would rise relative to renewables by 60-70 per cent.

- Total energy demand would be expected to decline by roughly 15 per cent relative to the baseline, with coal demand falling by 35 per cent to deliver more than half of the decline.

- In general, countries that have a higher energy intensity of output and those that consume relatively more carbon intensive fuels are more vulnerable compared with countries that predominantly use gas or renewables. For example, Russia, which is very energy intensive, and India, which continues to rely heavily on coal, are particularly exposed to the energy transition and a rising price on carbon.

Co-author of the report, Dawn Holland, said: “Carbon-pricing strategies are high on the agenda of world leaders. Whether via a carbon tax, where a fixed price is paid per tonne of greenhouse gas (GHG), or a ‘cap and trade’ principle, which sets a cap on the total amount of certain GHG that can be emitted. Using our National Institute Global Econometric Model (NiGEM), we show that a sudden and uniform $100 carbon tax applied across all economies could drive inflation higher and lower GDP by about 1-2% in most OECD countries, and considerably more in more carbon intensive economies. A well-planned carbon pricing strategy that is signalled in advanced would prove less costly…”

ENDS

For further queries or to arrange interviews, please contact the NIESR Press Office: press@niesr.ac.uk / +44 (0)20 7654 1954