Press Release: UK Economic Outlook – UK GDP growth revised up in 2021 but unemployment will still rise to 6.5%

FOR IMMEDIATE RELEASE

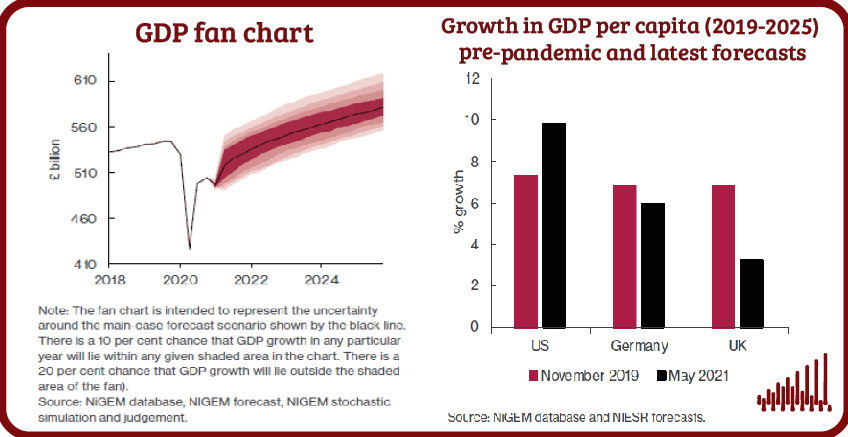

- Our central forecast for UK economic growth in 2021 has been revised up to 5.7 per cent, compared to 3.4 per cent in February, with 4.5 per cent growth forecast for 2022. The significant upward revision reflects a better-than-expected first quarter – a greater resilience to further lockdowns – and the large rise in Covid-related public spending in the 2021-22 fiscal year announced in the March Budget.

- The immediate economic effects of the virus, which have been concentrated in low-waged service sectors, are expected to wane, while remaining negative consequences of Brexit will make themselves felt over the long-run and largely in sectors less affected by Covid-19.

- The private non-traded services sector, which includes badly affected industries such as hospitality, is likely to see its output increase by 9 per cent this year after its pandemic-induced 14.75 per cent fall last year. But we expect it to shed a further 190,000 jobs after the furlough scheme comes to an end later this year.

- The poor Covid-19 performance has greater permanent cost for the UK compared with other major economies. The size of the economic contraction means that the level of GDP is nearly 4 per cent lower in 2025 than we had forecast it to be before the Covid-19 pandemic, equivalent to around £1,350 per person per year (2018 prices) falling further behind the US and Germany as a result.

- Thanks to the extension of furlough and other support measures to the autumn, we now forecast unemployment to peak at 6.5 per cent in the final quarter of this year (compared to 7.5 per cent in February). This central forecast is compatible with an assumption that around 450,000 of those remaining on furlough in September will not be taken back after the scheme ends.

- Income growth and a degree of forced savings under lockdown provide a strong basis for a consumption growth forecast of 5.9 per cent in 2021. We forecast household saving then to fall to a level higher than that seen before the pandemic but close to historical averages: a faster or further fall constitutes the principal upside risk to our consumption and GDP forecasts in 2021.

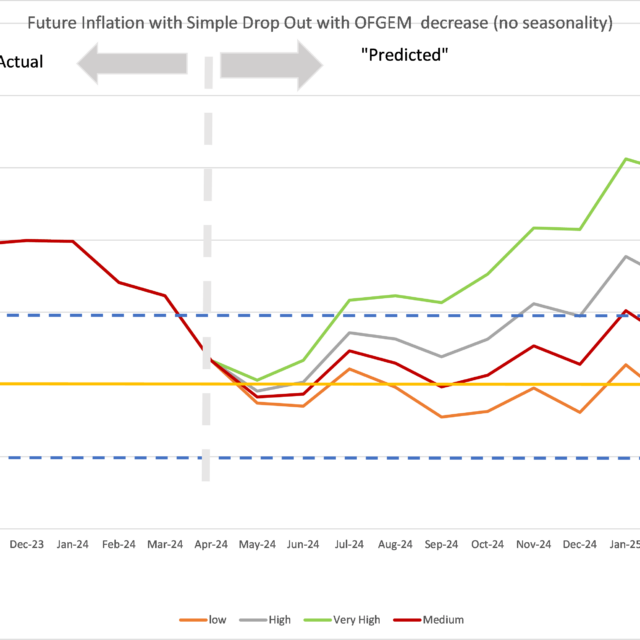

- Our central forecast is for CPI inflation to rise over the coming months, reaching 1.8 per cent in the final quarter of 2021 before falling to 1.5 per cent at the end of 2022 and settling just below its 2 per cent target between 2023 and 2025. Bank Rate is not forecast to rise until 2023 but there is considerable uncertainty regarding both the direction and instruments of monetary policy.

At a sectoral level, while the first national lockdown hit the whole economy, subsequent lockdowns affected mainly the private nontraded sector, which remains some 20 per cent below its February 2020 level.

As the economy re-opens and consumer confidence returns on the back of the successful vaccination programme, we expect a strong recovery in consumption expenditure starting from the second quarter, with positive spill-overs to industries like manufacturing, private traded services and construction. The tourism and hospitality sectors will likely continue to suffer for as long as international travel remains subdued.

At the regional level, the third lockdown resulted in a fall of economic output as measured by Gross Value Added (GVA) in all parts of the UK. The total drop was 2.4 percent in the first quarter of 2021 compared with the last quarter of 2020, but GVA is still projected to remain 9 percent below the pre-Covid-19 level. The economy is estimated to recover by the second quarter of 2023 with the North, Wales and Northern Ireland still 2 percent below their level in the fourth quarter of 2019.

As the higher and rising participation rate is not matched by job creation and vacancy fillings, the unemployment rate in London is projected to be the highest in the UK and to decrease slowly. Elsewhere, there is a lower rise in unemployment, but the pace of the recovery is almost equally slow. The rise in youth unemployment (18–24-year-olds) is particularly alarming, while the number of unemployed persons in the 25-49 year age groups were relatively moderate but increasing.

The rise in destitution is projected to be particularly acute in Scotland, the North West, Yorkshire and Humberside and the South East. Equally alarming is the projected incidence of food poverty among children.

NIESR Deputy Director, Dr Hande Kucuk, said: “Beyond short-term optimism, the outlook for the UK economy is less certain given the economic and social challenges that existed before the pandemic. Our analysis at sectoral, regional, and household level shows that despite the rhetoric about ‘building back better’ existing inequalities could be exacerbated by the pandemic and an uneven recovery. Now that the worst of the pandemic may be behind us, a new fiscal policy framework is needed to combine clear principles for spending and tax to support the ultimate long run objectives of economic policy – creating the conditions for more robust and inclusive growth.”

ENDS

——————————

Notes for editors:

The full forecast for the UK economy can be found here. Details of NIESR’s previous UK economic forecast can be found here.

For further queries or to arrange interviews and background briefings with our country specialists and senior researchers, please contact the NIESR Press Office: press [at] niesr.ac.uk / l.pieri [at] niesr.ac.uk / c.ridyard [at] niesr.ac.uk / 07930 544 631 / 07970 984913

For technical questions related to the forecast, please contact:

Cyrille Lenoël / c.lenoel [at] niesr.ac.uk

Rory Macqueen / r. macqueen [at] niesr.ac.uk

Hande Küçük / h.kucuk [at] niesr.ac.uk

Further details of NIESR’s activities can be seen on http://www.niesr.ac.uk or by contacting enquiries [at] niesr.ac.uk Switchboard Telephone Number: +44 (0) 207 222 7665