The UK’s annual rate of inflation in April 2024 was 2.3% – down from a peak of 11.1% in October 2022 – and it looks to remain low for a few months more.

Is this a ‘mission accomplished’ moment for the Bank of England, with inflation almost back to the target of 2% a year? Or is above-target inflation likely to return?

We are in a moment of some uncertainty, as was the case in 2021 when the possible effects of recovering from the Covid-19 lockdowns were hard to discern (as discussed in an earlier Economics Observatory article).

Then, it was unclear whether deflationary demand-side effects of the pandemic or inflationary supply-side effects would dominate. Now, there is the additional political uncertainty of the coming general election, although this is unlikely to have a major effect on inflation.

In 2024, the uncertainty is more one-sided and stems from geopolitics. Sanctions – such as those currently being imposed on Russia – tend to restrict the supply side; tariffs raise import prices; while wars and conflicts can disrupt trade directly. These are all ‘upside risks’ that can increase inflation.

But in addition to global influences, there are domestic pressures on inflation that affect the current figures.

Figure 1: Inflation rate

Source: Office for National Statistics, 2024

How should we interpret the current inflation figures?

The recent fall in inflation – from 3.2% in March to 2.3% in April – needs to be interpreted with care.

The headline inflation rate covers the 12-month period up to and including the month for which the figure is calculated. It is best to see the headline annual figure as the sum of the preceding 12 month-on-month (or ‘monthly’) figures.

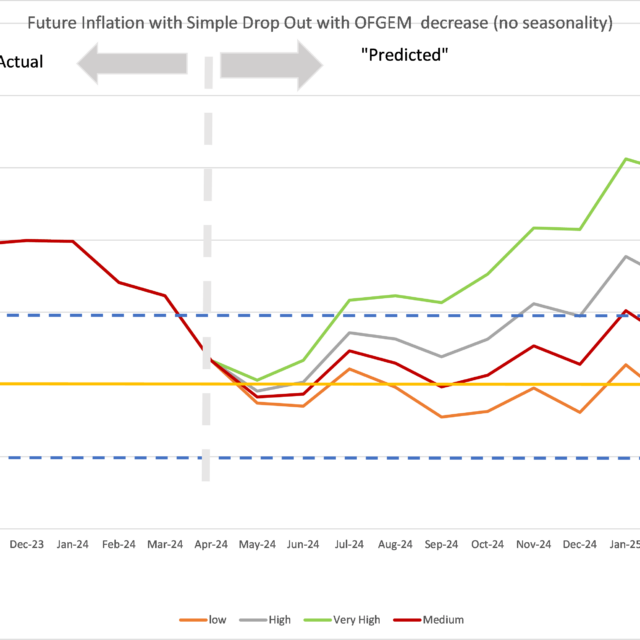

As we move forward each month, the change in the headline inflation comes from adding in the new monthly inflation data and subtracting the old inflation that drops out (economists call this the ‘base effect’).

Thus, as we moved forward from March 2024 to April 2024, the new monthly inflation for March-April 2024 of 0.3% ‘dropped in’, while the old inflation for March-April 2023 (which was 1.2%) ‘dropped out’. The overall change is the new minus the old – that is, a fall of 0.9%.

From this example, we can see that inflation can fall this year due to last year’s inflation dropping out. That is exactly what has happened in 2024 from February to April. Inflation was very high in February to April 2023, so as these data have dropped out a year later, the headline inflation figure has fallen.

But this downward pressure on inflation from 2023 will end in June 2024, reflecting the lower month-on-month inflation in the second half of 2023. The path of inflation going forward will be more influenced by the new data that have come in during 2024. To evaluate how the inflation rate may change, we can first look at the domestic side of things.

Domestic inflation risks

It is here that the news for inflation is not so good. Inflation in the UK is really a tale of two sectors: goods and services. Goods inflation is much lower – at 1% in April 2024 – than services inflation, which was almost 6%.

Wages tend to make up a large proportion of service sector costs, and wages (excluding bonuses) were growing at 6% annually on average over the period from January to March 2024. The national minimum wage was also increased by 9.8% in April 2024, which will bring knock-on effects in the coming months.

As a result, it is likely that service sector inflation will persist this year and into 2025. This will have a major effect on businesses such as restaurants, hotels, gyms and theatres, among others.

Increases in housing costs are also having an effect. These feature less in the consumer price index (CPI) measure of inflation, which only includes actual rentals. But they do form a major part of the consumer prices index including owner-occupiers’ housing costs (CPIH) and are mainly captured by the owner-occupied housing (OOH) element.

This is largely also driven by rental costs, which are increasing more rapidly. The March 2024 annual inflation in OOH was 6.3%. This is an index that tends to move slowly, and the housing crisis underlying the increase does not seem likely to go away any time soon. Even though the rise in housing costs is not included in the CPI, it indicates a broader inflationary pressure that can lead to further inflation that will be captured by CPI.

The housing crisis is also likely to put upward pressure on wages as we move forward, since employees will demand higher wages to help to afford their rent or mortgages. This is especially the case given the high proportion of renters among the under-40s. There is little sign that the increases in rental prices will slow down soon, so the pressure on wages is likely to continue.

Core inflation (inflation excluding food and energy) also plays a role. This is seen as an important statistic by central banks, such as the Bank of England, as it has been a good indicator of inflation over the next 12 months.

The idea is that core inflation is more persistent than headline inflation, which includes the volatile categories of food and energy. Core inflation also remains high – in April 2024, it was 3.9%. This is because much of the recent drop in inflation reflects ‘energy-related’ costs (the price cap imposed by OFGEM, the UK regulator of gas and electricity markets), which do not directly affect core inflation.

These three factors – wages, housing and core inflation – all indicate that inflationary pressures will persist later into 2024. Without the downward pressure from big dropouts from 2023, this means that inflation will probably bounce back later in 2024.

It therefore seems that the fall in inflation in April 2024 is likely to be more of a ‘down but not out’ moment rather than ‘mission accomplished’.

Geopolitical inflation risks

To this domestic picture, we can add geopolitical elements.

The effects of the invasion of Ukraine and the sanctions on Russia that followed were the main cause of the inflation spike in 2022-23. By now, the inflationary effects have largely worn off.

World supply chains for energy and food have adjusted to the sanctions and the European Union and the United States have been reluctant to impose secondary sanctions on third parties – countries that continue to trade with Russia in the sanctioned commodities (China and India, for example).

The initial spike in energy and food prices caused by the sanctions and the war itself have either ended or reversed as a result. Prices may be higher now than they were in 2021, but they are not rising further.

Nevertheless, an extension of the war to a direct conflict between NATO and Russia could result in a range of highly negative outcomes. It would, at the very least, cause a major disruption to trade that would bring an increase in inflation.

Pressure is currently building within NATO to intervene directly as Ukraine faces setbacks on the battlefield. It remains to be seen whether this will lead to concrete action.

The second major geopolitical flashpoint is the Middle East. The conflict in Gaza has many potential routes for expansion. Already, we have seen disruption to Red Sea trade by the Houthis, which the United States and its allies have been unable to stop.

Trade through the Suez Canal has been reduced by about 45% and this has caused delays and cost increases as ships are re-routed around the Cape of Good Hope.

If Iran also becomes involved, this would probably lead to the closing of the Straits of Hormuz and a cutting off of the supply of oil and liquified natural gas to continental Europe and the UK. It is thought that this could lead to a massive increase in the price of oil globally and hence to another spike in inflation.

Lastly, we have the potential for conflict between China and the United States. The ‘Thucydides trap’ – coined by Harvard political scientist Graham Allison – refers to a phenomenon where war is a potential result of one superpower overtaking another.

Currently, we are seeing a trade war between China and the United States, instigated by Donald Trump in 2018 when he introduced tariffs on Chinese imports and banned Chinese communication and technology company, Huawei, from the US market.

These measures have been continued and intensified by Joe Biden. In particular, the ‘chip wars’ have attempted to restrict Chinese access to top-of-the-range microchips and technologies developed in the United States. Large tariffs have also been introduced by the Biden administration on steel and aluminium, electric vehicles, solar panels and other goods.

This Sino-US trade war has not affected UK trade with China too much. The UK has yet to impose tariffs on China, although it has restricted use of some Chinese technologies including Huawei 5G.

More concerning is the potential for direct armed conflict between China and the United States – for example, over the status of Taiwan and small islands in the South China Sea.

If this were to break out, it would result in a major supply shock. China currently produces over 30% of the world’s manufactured goods and it is embedded in most global supply chains. Many consumer items would become unavailable and manufacturing in the UK would be starved of necessary inputs.

What’s more, military conflict would also interrupt UK trade with Japan, South Korea and Taiwan – all of which could be directly involved in any Sino-US hostilities.

The severe shortages of manufactured goods and intermediate inputs would potentially cause a major inflation spike in the UK and around the world. China and the United States both have a lot to lose from such a conflict. But when world hegemony is at stake, leaders may be driven to take extraordinary risks (hence the trap associated with Thucydides, the ancient Greek historian who recounted the history of the Peloponnesian war).

What about interest rates?

The Bank of England’s Monetary Policy Committee (MPC) has indicated that it will be cautious when it comes to cutting interest rates from their current high of 5.25%.

There was an historic turning point in monetary policy in October 2023, when the MPC interest rate exceeded the inflation rate for the first time since 2009. Interest rates have remained at 5.25% while inflation has fallen.

One reason is that a majority of MPC members have been reluctant to cut rates up until now because they too believe that there might be a ‘bounce back’ in inflation later this year. Cutting rates only makes sense when there is clear evidence that inflation will remain low. Further, the geopolitical upside risk also leads to caution.

But it is clear that the MPC should cut rates once safe to do so. The current level of interest rates is not high by historic standards – it was around this level prior to the global financial crisis of 2007-09.

The difference is that economic growth was robust then, at around 2% a year. Since the late 2000s, growth has been weak; and since the pandemic, it has been veritably sluggish, with little growth relative to 2019.

Indeed, growth going forward is forecast to be around 1% for the next five years, according to the National Institute of Economic and Social Research (NIESR) Economic Outlook for May 2024. Hence, a more appropriate interest rate might be around 3-4% (that is, the inflation target of 2% plus the equilibrium real interest rate of 1-2%).

While it is right that the MPC should be cautious when it comes to cutting interest rates, this should not rule out a small symbolic cut sometime in the middle of 2024. Such a decision would signal that further interest rate cuts will be coming once domestic inflationary pressures have abated and geopolitical uncertainties have begun to get resolved.

It seems that without nasty external shocks, inflation will fall sustainably to 2% in 2025 and interest rates can gradually be cut later in 2024 and early 2025 to this ‘new normal’ of 3-4%. Having said that, we should be conscious that a lot that can happen before then.