CPI Falls to 4.6% as Energy Prices ‘Drop Out’ of Basket

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Main points

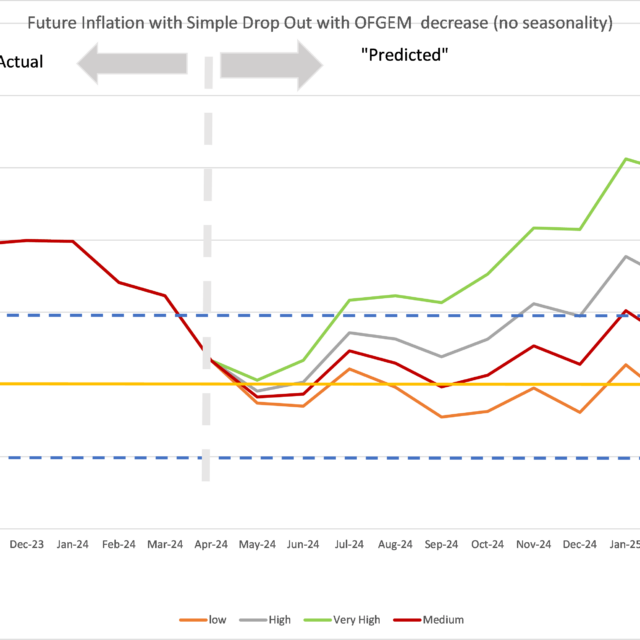

- Annual consumer price inflation was 4.6 per cent in October, the lowest level in two years, decreasing from 6.7 per cent in September. This figure reflects a large fall in the housing, electricity, gas and other fuels category which contributed 1.6 percentage points out of the overall monthly fall. The drivers of these decreases were energy prices, which rose steeply last October but have now ‘dropped out’ of the CPI basket: for instance, gas costs fell by 31 per cent in the year to October 2023 while electricity costs fell by 15.6 per cent in this time.

- Food inflation fell to an annual rate of 10.1 per cent, down from 12.1 per cent in September. Still, that it remains so elevated and in double-digits is concerning since there is no government support to help households (especially lower income households, who spend a greater part of their incomes on food) offset this cost.

- Core CPI was 5.7 per cent in the year to October, down from 6.1 per cent in; NIESR’s measure of trimmed-mean CPI inflation fell from 7.3 to 6.5 per cent; and annual services CPI inflation fell slightly from 6.9 to 6.6 per cent. These measures indicate that underlying inflationary pressures remain elevated (and indeed now above the headline CPI rate) and therefore may continue to generate persistence in the headline rate. That said, it is good news that they are easing significantly.

- Our recent Autumn UK Economic Outlook forecasts that inflation will reach the Bank of England’s 2 per cent target by the end of 2025.

“Annual CPI inflation was 4.6 per cent in October, down from 6.7 per cent in September, driven by a base effect (i.e. the large energy price increases that occurred in October 2022 ‘dropping out’ of the CPI basket this October) and further by not being replaced by ‘new inflation’. Core CPI fell from 6.1 per cent in September to 5.7 per cent in October, while NIESR’s trimmed-mean CPI inflation measure fell from 7.3 per cent to 6.5 per cent. While these measures indicate that underlying inflationary pressures are now more elevated than the headline figure, it is a good sign that they are continuing to ease. Though the headline figure has halved relative to last January, we still have a way to go before inflation reaches the Bank of England’s target, which, as set by the government, is to achieve a 2 per cent inflation rate. It is important to stress that control of inflation is the job of the Monetary Policy Committee of the Bank of England and not the government. It is largely its actions, raising interest rates, that have enabled inflation to fall in this time, alongside decreasing energy prices (given that the UK is an energy importer, this is an exogenous factor). It would therefore be helpful to move the narrative away from this halving objective, and back towards the 2 per cent target.”

Paula Bejarano Carbo

Associate Economist, NIESR

For a breakdown of what inflation is and how it is calculated, read our blog post here.