Market Expecting Interest Rates to Rise Further

Pub. Date

Pub. Date

21 June, 2022

Pub. Type

Pub. Type

Main points

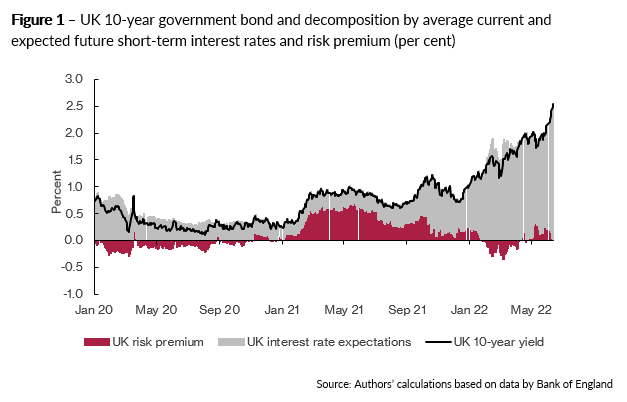

- We decompose long-term bond yields into two components: expectations of the future path of short-term bond yields and a term premium. The term (or risk) premium is the compensation investors require for bearing the risk that short-term bond yields will not evolve as expected.

- The 10-year bond rate has been increasing since December, initially as a result of the beginning of the Bank tightening cycle, and from February through June also as a result of the Russia-Ukraine conflict. Short-term interest rate expectations are now much above the pre-pandemic level, and a further compression in the term premium suggests the market sees little uncertainty that interest rates will continue to go up.

- The adjustment in the UK risk premium is consistent with a low growth-high inflation scenario as the result of the war. Based on our latest GDP growth tracker, April’s headline 0.3 per cent fall in GDP appears to be principally driven by the winding-down of some of the pandemic-related measures, such as the Test and Trace programme, which had made significant positive contributions to GDP over most of the Covid-19 period. The risk premium increased from -0.2 in mid-March to 0.25 by the beginning of June, and it has somewhat receded afterwards. Interest rate expectations, capturing markets’ expectations of rates over the longer horizon, have been increasing steadily recently, up to 2.5 per cent by mid-June, the highest rate since the start of the pandemic, as markets have reacted to the higher inflation news as the result of the Russia-Ukraine conflict.

- The UK's headline inflation rate surged to 9 per cent in April, the highest since 1982, owing to soaring energy prices, providing another sign that consumers' living standards are being squeezed. As inflation data continue to be strong, 10-year Government bond rates are expected to rise further over the coming months.

- US government bond rates had also increased above 3 per cent at the end of May, with a still negative term premium at the 10-year maturity, consistent with the estimates by the Federal Reserve Bank of New York. Interest rate expectations have continued to increase to average 3 per cent as the latest FOMC meeting on 14-15 June resulted in an interest rate hike of 75bp in a pledge to get inflation back to 2 per cent. The Monetary Policy Committee of the Bank of England, by contrast, only raised rates by 25 basis points.

- German 10-year Bund yields continued to fluctuate around zero as the result of both high demand for safe-haven assets and the slow-down of the ECB asset purchases announced in April. Euro-area interest rate expectations continued to grow positive, reaching 1.7 per cent in June. Excluding energy, inflation rose to 4.6 per cent in May, from 4.1 per cent in the previous month, more than double the European Central Bank's target. This indicates that inflationary pressures in the Euro Area are still high and might have not peaked yet.

“UK short-term interest rate expectations are continuing to rise, reaching their highest level since the pandemic. The continued low term premium suggests the market is fairly certain that interest rates will continue to go up.”

Dr Corrado Macchiarelli

Research Manager for Global Macroeconomics

See our previous term premium tracker to follow the analysis