Non-Essential Retail Prices Drag Down Inflation

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Non-essential retail prices drag down inflation

Main points

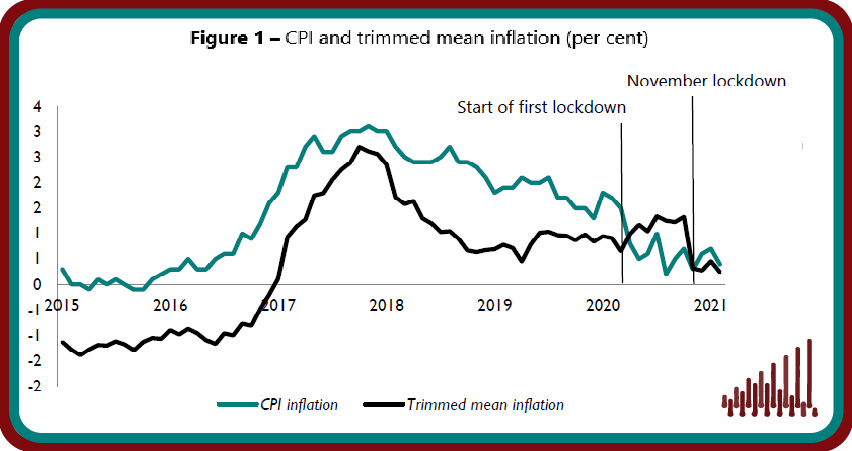

- After increasing steadily for three months, underlying inflation has moderated to the lowest level recorded in four years. Our measure of underlying inflation recorded 0.2 per cent in the year to February 2021, down from 0.5 per cent in January 2021, as measured by the trimmed mean, which excludes 5 per cent of the highest and lowest price changes (figure 1).

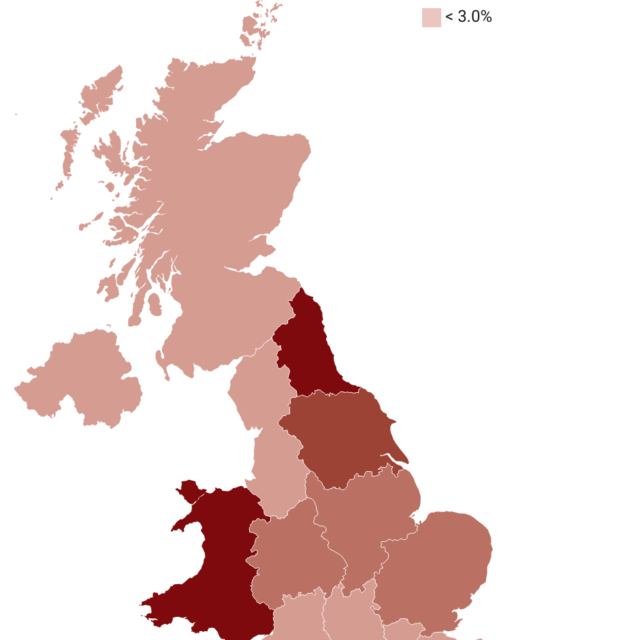

- At the regional level, underlying inflation was highest in Wales at 2.2 per cent and lowest in the North West where prices declined by 0.5 per cent in the year to February 2021 (table 1).

- 22.6 per cent of goods and services prices changed in February, implying an average duration of prices of 4.4 months, shorter than the long-term average of 5.1 months. 5.9 per cent of prices were reduced due to sales, 5.1 per cent fell for other reasons and 11.6 per cent recorded increases (figure 2).

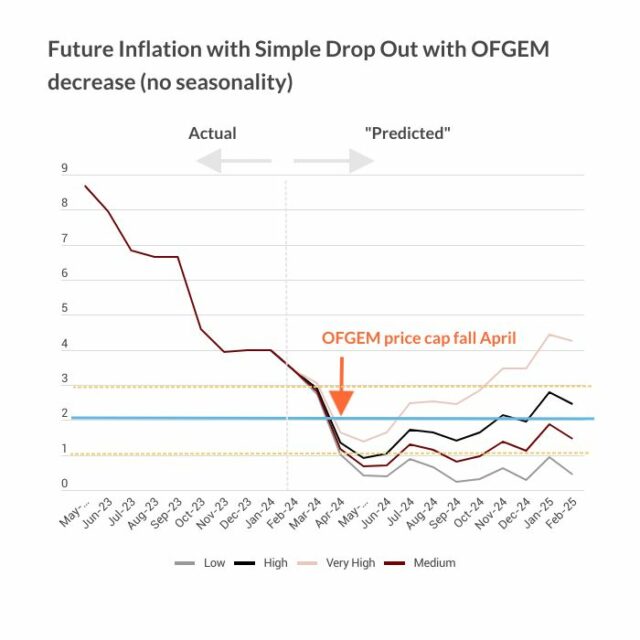

- Consumer inflation will likely oscillate in the short term as prices reflect the ongoing lockdown imposed in January 2021. Historically the month of February would see an increase in headline inflation following the unwinding of January sales, but with non-essential retail still affected by lockdown, the decrease in headline inflation is more pronounced.

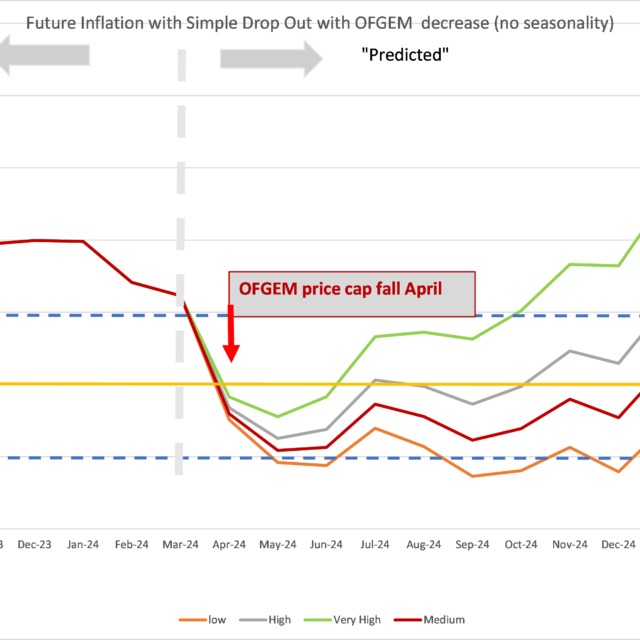

- CPI inflation is likely to pick up in the second half of the year but stay below the Bank of England’s target of 2 per cent in the year to February 2022.

“Headline inflation decreased to 0.4 per cent in February, down from 0.7 per cent recorded in January. Our measure of underlying inflation, which excludes extreme price movements, decreased to 0.2 per cent in February. Inflation is expected to reflect some volatility in the short term as the effect of ongoing lockdown impacts consumer prices in the non-essential retail market. We expect inflation to rise in the latter half of the year as the economic recovery gains pace on the back of a successful vaccination programme and higher producer costs are passed on to consumers, but we still expect inflation to remain below the Bank’s 2 per cent target in the year to February 2022.”

Janine Boshoff

Economist, Macroeconomic Modelling and Forecasting