Is it all quiet on the inflation front?

The COVID-19 pandemic has the potential to have a significant impact on medium-run inflation expectations particularly if considered in conjunction with large fiscal stimuli, ultra-loose monetary policies and the risk of de-globalization. The recent review of monetary policy framework by the Federal Reserve, focusing on an average inflation target strategy, highlights how difficult it can be to keep inflation expectations well-anchored when secular factors are at play (i.e.

The COVID-19 pandemic has the potential to have a significant impact on medium-run inflation expectations particularly if considered in conjunction with large fiscal stimuli, ultra-loose monetary policies and the risk of de-globalization. The recent review of monetary policy framework by the Federal Reserve, focusing on an average inflation target strategy, highlights how difficult it can be to keep inflation expectations well-anchored when secular factors are at play (i.e. the well-known decline in the neutral real rate of interest, r*) and a shock of the scale of COVID-19 hits the economy, with ensuing uncertainty.

Several factors could “in theory” light inflation expectations up over the medium-term

There are many factors that play into the formation of inflation expectations. The large government stimuli, for instance, may have the effect of increasing the bargaining power for some sectors in the labour market, leading to an increase in labour cost that would feed into higher inflation expectations and thus wages. Equally, the current ultra-loose monetary policy, including the continuation of the large asset purchase programmes or targeted lending, imply the presence of the central bank as a large institutional actor in the fixed-income market. Such bond-buying programmes, designed to push up inflation from its current below-target levels, may “in theory” contribute to lift inflation expectations up, particularly if combined with an expansionary fiscal policy. This might not happen considering that the existing government support schemes will have to be undone at some point.

A third factor to affect inflation expectations is the risk of de-globalisation. Before COVID-19, there was evidence of global inflation cycles that coincided with increased globalisation. The COVID-19 pandemic has exposed one of the downsides of globalisation: a rapid propagation of the virus across borders and an inability of countries to provide basic needs when borders are closed. Unwinding the globalisation process could mean the return of higher inflation as new restrictions on cross-border movement of labour and disruptions in global supply-chains could push production costs up and reduce competition.

UK and US households provide mixed signals

The Bank of England/TNS Inflation Attitudes survey shows that inflation expectations have fallen in the UK since the outbreak of the pandemic. Households’ expected inflation for next year declined from 2.9 percent in February to 1.9 percent in May. This possibly reflects the fact that – faced with increased uncertainty about their future income during the pandemic – consumers have reduced consumption. This negative demand shock drove consumer prices inflation and inflation expectations down for the short-term.

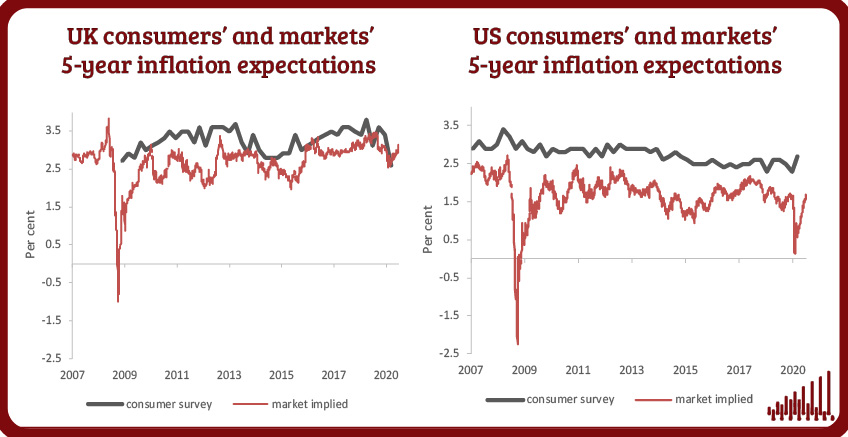

NIESR’s GDP tracker predicts that the outlook for the third quarter of 2020 is for growth around 15 percent as the economy reopens, on the assumption of no second pandemic wave. At the same time, real-time wage estimates for the UK economy suggest that average earnings are expected to recover slightly in the short term as employees return from furlough, with average earnings expected to grow at an annual rate of 0.2 percent. However, it is unclear whether this will lead to higher short-term inflation expectations, particularly as households’ medium-term expectations also fell as shown in Figure 1, while alternative measures of households’ medium-term expectations from YouGov/Citigroup have remained broadly stable.

Looking at financial markets, UK break-even 5-year inflation declined from about 3 percent in the first 2 months of 2020, to 2½ percent in March, before rebounding to about 3 percent in August, approaching pre-COVID-19 levels (Figure 1).

Such a difference between consumer surveys and financial market expectations may well have to do with the fact that consumers tend to be more backward looking when forming their expectations.

For the US, the University of Michigan Consumer Survey shows that the pandemic has not changed households’ expectations about medium-term inflation. The five-year inflation expectation remained around 2½ percent, as it has been during the last four years (Figure 2). The Survey of Consumer Expectations on inflation analysed by the NY Federal Reserve confirms that medium-term inflation expectations have not significantly changed since the beginning of the COVID-19 crisis, highlighting simultaneously that uncertainty about inflation has increased across survey participants. The fact that medium-term inflation expectations did not drop in the US may also have to do with the combination of larger monetary and fiscal responses. The fiscal stimulus has been comparatively more substantial in the US than in the UK (9 percent of 2019 GDP in the US versus 6 percent in the UK according to Bruegel institute), although loan guaranties have been larger in the UK.

Markets initially expected a drop in inflation, but are now back to pre-COVID-19 levels

US Treasury inflation-protected swaps (TIPS) suggest that expected inflation has only briefly declined since the outbreak of the pandemic. US five-year expected inflation declined from between 1½ to 1¾ percent in the first two months of 2020 to ½ percent in March before rebounding to 1½ percent in August (Figure 2).

The modest decline in inflation expectations in the US and the UK according to bond markets stands in stark contrast with what was seen during the financial crisis, when five-year expected inflation became negative in both the US and UK, reaching troughs of -2.2 percent in the US and -1 percent in the UK, in November and December 2008.

A comparison of inflation expectations over time suggests that markets are possibly betting that the COVID-19 crisis might be more short-lived than the financial crisis. Perhaps, a convincing explanation for this is that the financial sector is much better capitalised now as it was on the wake of 2008/09. Also, the latter might be related to the supply shock that COVID-19 and the associated lockdowns measures brought about, alongside the demand shock. Lost output during the lockdown (and during partial re-opening) implied a rise in unit costs (mostly due to fixed costs or costs like rent etc.) and higher mark-ups (mostly due to a lower turnover in the service sector). These might have played a role in the milder downward adjustment in inflation expectations despite the much larger contraction.

Longer maturities along the implied inflation spot curve strikingly confirm how both curves have remained flat for both the US and the UK. Financial markets are still predicting lower implied inflation at lower maturities, but the difference between the five-year and 30-year is unimportant: US 30-year expected inflation is six basis points higher than the five-year at 1.71 percent and UK 30-year expected inflation is 14 basis points below the five-year at 3.15 percent. This does not mean markets expect the Fed or the Bank of England not to achieve their inflation target. Rather, it implies that the perceived risks of deflation based on the yield curve are anyway limited for now.

To conclude, there seems to be “no big news” on the inflation front at the moment. Although inflation expectations remain low for the short-term, the information contained in financial markets shows little to no changes for the medium-term, while movements in household surveys remain rather mixed, particularly for the UK. However, as the relationship between expectations and outcomes has become blurred, especially in recent years, we should be careful when assessing the role of expectations in guiding future policy, particularly during periods of heightened uncertainty such as the current one.