Nothing has changed: No deal does not look to be a good deal

With a Conservative leadership contest in full swing and differing interpretations of what European election results mean for EU withdrawal, the public debate has yet again turned to a no-deal Brexit, i.e. leaving the European Union to trade on a minimum set of rules defined by the World Trade Organisation. These political shenanigans do not change the economic arithmetic whereby leaving the EU without a deal would inflict a significant economic cost compared to the alternatives.

With a Conservative leadership contest in full swing and differing interpretations of what European election results mean for EU withdrawal, the public debate has yet again turned to a no-deal Brexit, i.e. leaving the European Union to trade on a minimum set of rules defined by the World Trade Organisation. These political shenanigans do not change the economic arithmetic whereby leaving the EU without a deal would inflict a significant economic cost compared to the alternatives.

Since the Prime Minister’s announcement last week to resign on 7th June, betting odds on a no deal have increased, implying a probability of 30 per cent for such an outcome, twice as high as for most of the time since Article 50 was extended at the end of March (figure 1). This is matched by financial markets which now price Sterling at substantially less than $1.30, a year-to-date low, corresponding to more than 78 pence per US dollar. This blog post aims to review the economic trade-offs that come with a no-deal exit by pulling together recent work published by NIESR. These trade-offs have been clear ever since a withdrawal from the EU has been discussed (see here and here for work undertaken by NIESR colleagues nearly two decades ago and prior to the referendum).

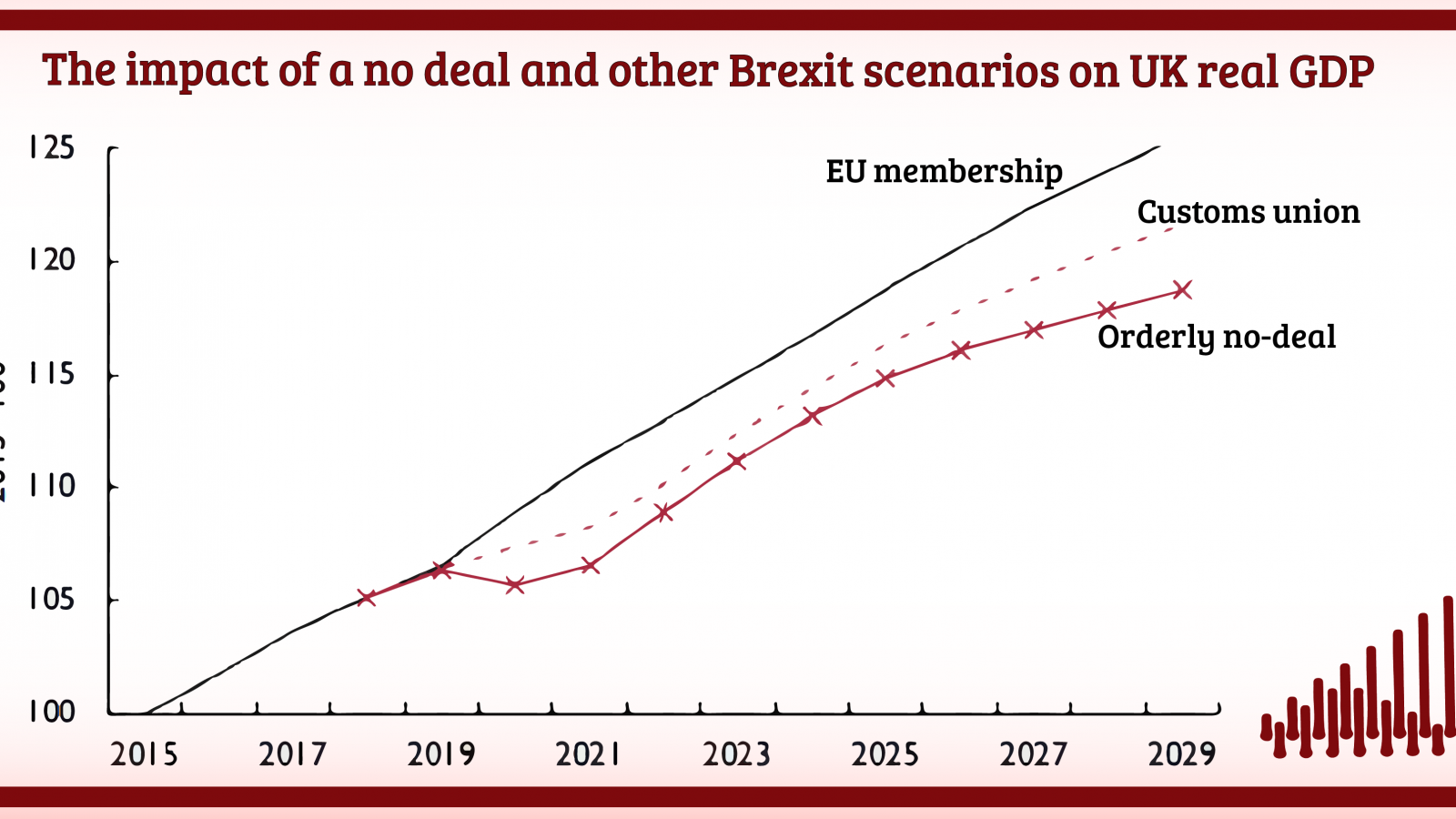

Exiting the EU customs union and single market would enable the UK to decide its own external tariffs and it would no longer be bound by rules commonly agreed on in the EU’s ‘acquis communitaire’ and by the European Court of Justice that enforces these rules. This would come with a substantial economic cost that arises from barriers to trade between the UK and the EU in the form of tariffs and, most importantly, regulatory barriers. Some of this cost would materialise immediately and further increase gradually over time, as firms trade fewer goods and services, investment by foreign firms in the UK reduces as access to the EU market is inhibited and the UK loses some of its appeal to workers from abroad while a lack of foreign competition disincentivises innovation and thus, productivity gains. We estimate that UK economic output would be 5-6 per cent lower some ten years after exit compared to continued EU membership (figure 2).

For a detailed discussion of the assumptions underlying our estimates, see here and here. Our analysis of a no-deal outcome and other Brexit scenarios has been done in two steps. First, we assess what would change as a result of leaving the EU. Second, we look at how these changes would feed through the economy, using the Institute’s global macroeconomic model NiGEM. While being surrounded by a large degree of uncertainty and based on different modelling approaches, our estimates are similar to those provided by other institutions, including the Government Economic Services.

Figure 2 illustrates that the larger barriers to trade are in a future economic relationship between the UK and the EU, the larger we would expect the economic impact to be. We estimate that a UK-EU customs union would be associated with a GDP loss of around 3 per cent compared to continued EU membership, nearly half of the impact associated with no deal. While goods trade would face fewer frictions in such a scenario, exiting the EU single market would make it substantially harder to trade services with the EU – a material economic burden in view of the importance of services trade to the UK economy (see also here). If the UK would remain in the EU customs union and single market, we would expect the economic impact to be substantially lesser.

Not being bound by single market rules and a common external tariff of a customs union with the EU would provide the UK with more flexibility to negotiate conventional free trade agreements with non-EU countries. Yet the economic benefit of such agreements would at best be around 0.3 per cent of GDP, relative to the loss of 5-6 per cent in the no-deal case (and an estimated loss of 4 per cent in a scenario in which the UK and the EU negotiate a free trade agreement). This is because evidence suggests that geographic distance greatly reduces bilateral goods trade while services trade remains small outside the tightly knit regulatory framework provided by the EU single market.

Most of our no-deal analyses focus on the long run, i.e. the economic impact ten or more years after exit. This is because shorter term effects are more uncertain and depend on the timing of exit and immediate policy responses. We assume an exit would be orderly with contingency measures in place and financial stability safeguarded. As long as inflation expectations remain in line with the Bank of England’s 2 per cent target, there may be room to ease the adjustment of the economy as a whole in the direct aftermath of no deal (see here and listen here). There would still be losers and winners and it would not change the fact that in the long run economic capacity would be weaker than otherwise. But the cost of adjustment could be spread more evenly over time.

There are other trade-offs. Absent technological innovations, a frictionless border on the island of Ireland would mean that Northern Ireland remains part of a customs union with the EU and adheres to certain single market rules. Avoiding regulatory differences between Northern Ireland and Great Britain implies that this would have to apply to the UK as a whole. In addition, a smaller economy as a result of trade barriers between the UK and the EU is likely to lead to significantly less tax revenue, more than offsetting any gains from ending fiscal contributions to the EU budget (see discussion in here). The revenue shortfall would have to be met by accepting more borrowing, higher tax rates or less government spending. Finally, a post-Brexit migration policy would have to reconcile employers’ needs for skills with complex public attitudes towards immigration (find a summary of recent research on this topic here).

Any new Prime Minister will face these very same trade-offs. And it is time for them to feature more clearly in the public debate.