Inflation Set to Rise in 2025

An updated Complex MRN Inflation Forecast – Up to and including December 2024

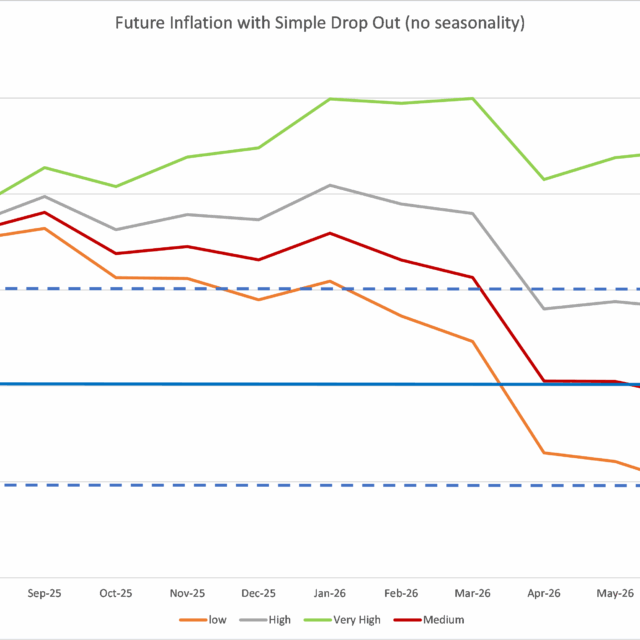

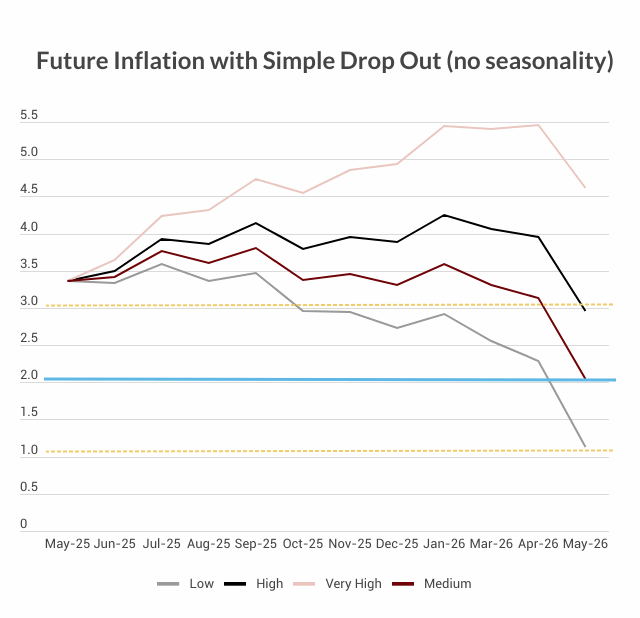

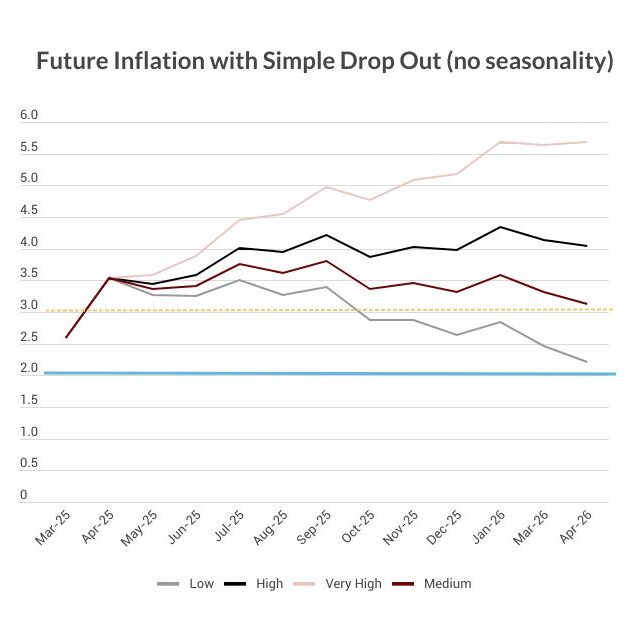

In this blog we are reporting the update if the simplest MRN, based only on the CPI data itself. The training data is from January 1999 up to and including December 2024 and the forecasts are of month-on-month inflation for the period January 2024 to December 2025. We combine this with the know own “drop-outs” from January 2023 to December 2024 to provide forecasts for the Annual CPI inflation up to and including September 2025. For the details of modelling annual inflation from month on month forecasts, see NIESR Economic Outlook Summer Outlook 2021, Box A: The simple arithmetic of inflation. Using “drop-in” and “drop-out”). For the MRN modelling approach see NIESR Economic Outlook 2024 Box A: A Neural Network Approach to Forecasting Inflation.

In this blog, we show the forecast in three different ways. First, the forecast for the headline inflation (the burgundy line). Second the month on month inflation for each month in brown. Lastly, in the dotted line shows the annualized inflation rate derived from the three month moving average of the monthly inflation from February to November. The December figure is the actual figure, with the forecasts from January onwards. We have included the OFGEM price increases for January (actual) and April (forecast): the former added 0.05 percentage points and the April is forecast to add 0.11 percentage points to inflation in those months.

The forecast starts from the actual December figure of 2.5% (headline) and 0.3% (monthly). The forecast for January is of a significant increase in inflation to 3.1%. This increase is almost entirely due to the “drop out” of the Dec-Jan 24 inflation of -0.56%: there was a very large negative sales effect for January 2024. The MRN predicts an unusual positive value of monthly inflation of 0.04%, with the annual inflation figure thus increasing by 0.6 percentage points to 3.1% after rounding.

Thereafter, inflation falls to 2.3% by March 2025 before taking off again to over 3% from June onwards. We are sceptical of the longer run forecasting ability of the simple MRN and so discount the forecasts beyond 6 months. The simple MRN may only be capturing the “pattern” that when inflation rises above a certain level it tends to rise even higher (this has happened in the training period during the GFC and of course the more recent cost of living crisis). However, the simple MRN has been as accurate as the more complex MRNs in a short horizon of a few months, so we are much more confident about the forecasts to March 2025. In Kelly et al (2024), the forecast performance of the Simple MRN is shown to be the best in comparison to the other MRNs at the one and three month forecast horizon according to the Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), Symmetrical Mean Absolute Percentage Error (SMAPE), and Theil’s U.