Related Themes

Macro-Economic Modelling and ForecastingTags

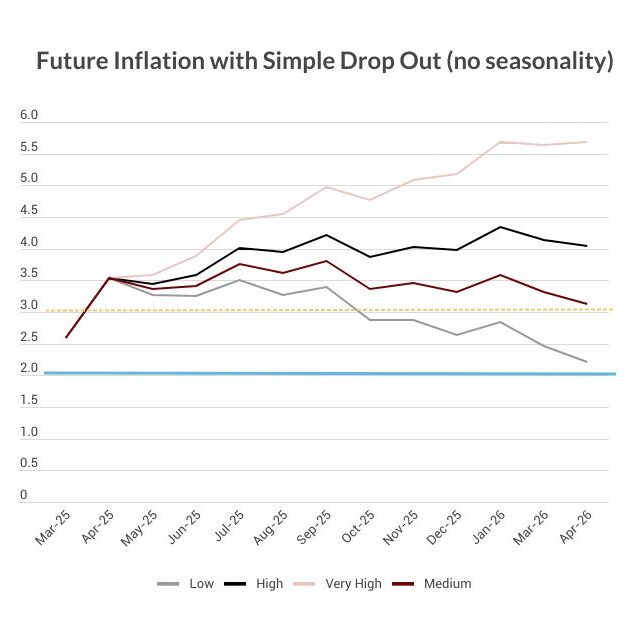

In this blog we present the simple MRN (based on just the CPI data) to forecast inflation from April 2025 to March 2026. The training data for both is from January 1999 up to and including March 2025, and the forecasts are of month-on-month inflation for the period April 2025 to March 2026. We combine this with the already-known “drop-outs” from March 2024 to March 2025 to provide forecasts for the Annual CPI inflation up to and including March 2026. For the details of modelling annual inflation from month-on-month forecasts, see NIESR Economic Outlook Summer Outlook 2021, Box A: The simple arithmetic of inflation. Using “drop-in” and “drop-out”). For the MRN modelling approach see NIESR Economic Outlook 2024 Box A: A Neural Network Approach to Forecasting Inflation.

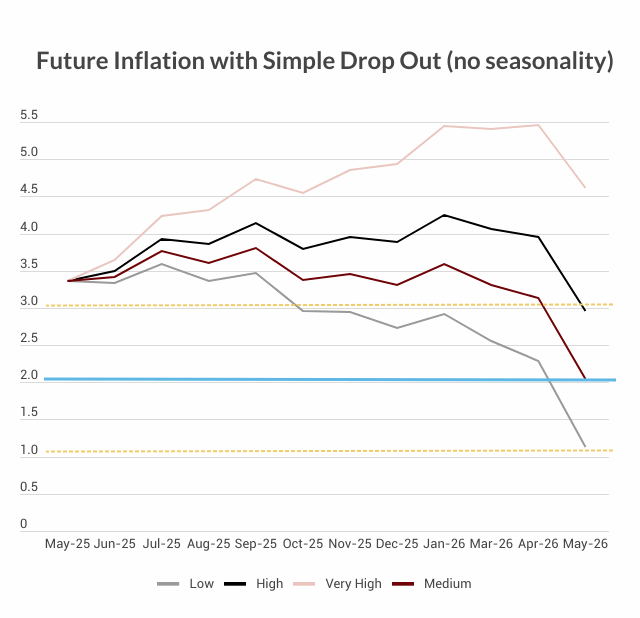

The forecast starts from the actual March figure of 2.6 per cent and is shown in the Chart:

The simple MRN predicts a high level of inflation for April, with the CPI inflation figure returning to 3 per cent. After a small fall in May, inflation then increases relentlessly until March 2026 when it is over 5 per cent, reaching 4 per cent by November 2025. It will be interesting to see how close the April figures released on Wednesday are to the simple MRN’s prediction.

This is a pessimistic forecast of inflation, but it is not out of line with the NIESR Summer Outlook, which envisages inflation increasing to 3.7 per cent by the third quarter of 2025. However, the NIESR forecast is for inflation to peak and then start declining in the fourth quarter, which the MRN does not agree with.

We are unable to update the intermediate MRN (which includes additional variables such as the 10-year gilt yield, PPI, the Bank Rate, real GDP and the Sterling effective exchange rate) because the ONS has “paused” its publication of PPI data for a few months. However, we do hope to produce an updated “small intermediate” MRN which uses the available data less the PPI.

Related Blog Posts

Scenarios and substance: how the BoE can improve its analysis

Benjamin Caswell

25 Jun 2025

3 min read

Inflation will Remain Above 3 per cent Throughout 2025 and into 2026

Huw Dixon

18 Jun 2025

1 min read

Inflation Unexpectedly Rises to 3.5 per cent and Will Remain Above 3 per cent Throughout 2025

Huw Dixon

21 May 2025

4 min read

The Difficulties Facing the Bank of England

Fergus Jimenez-England

Benjamin Caswell

19 May 2025

7 min read

Related Projects

Related News

Related Publications

Related events

NiGEM Workshop: Introduction of Fiscal Packages into NiGEM (International Examples)

This workshop, aimed at those users who are familiar with NiGEM and the way the model operates, will provide a step-by-step guide to introducing fiscal packages. The contents will be…

NiGEM Workshop: Modelling Fiscal Rules in NiGEM

This workshop is an advanced course on fiscal policy rules in NiGEM, covering how to set them in forecast and simulation, how government debt feeds through into the model, and…

NiGEM Workshop: Forecasting in NiGEM

Aimed at users who are already familiar with NiGEM and the way the model operates, this workshop provides instruction in how to create a new forecast base. It includes an…

NiGEM Workshop: Unwinding Conflict Scenarios in NiGEM

This workshop is designed for users who are familiar with NiGEM and provides a step-by-step guide in building complex scenarios using different channels in NiGEM.

NiGEM Workshop: General Imbalances and Structural Trends: An Exercise Using NiGEM

This workshop is designed for users who are familiar with NiGEM. It is focused on exploring trade imbalances, and how different shocks in NiGEM can adjust them.

Summer 2023 Economic Forum

Spring 2023 Economic Forum