Inflation Will Remain Above 3 per cent Well Into 2026

Annual CPI Inflation held steady in August at 3.8, unchanged from July. The new inflation in the month from July to August 2025 was 0.3 per cent which combined with the inflation dropping out from the same months the year previously (0.3 per cent) led to no change in the headline inflation rate. Inflation is likely to remain in the 3.3 to 4 per cent range for the rest of 2025, with the September figure rising to 4 per cent.

Services annual inflation has dropped to 4.7 per cent from 5.0 per cent in June. Goods price inflation has increased slightly from 2.7 per cent to 2.8 per cent. Core inflation (CPI excluding food and energy) has fallen slightly to 3.6 per cent from 3.8 per cent. The latest ONS data on wages (May to July 2025) shows annual inflation remaining stubbornly high at 4.8 per cent, despite a slight fall from the previous month’s 5.0 per cent. Taken together, these figures indicate that inflationary pressures are still with us and likely to persist into the coming months. The persistent high wage inflation combined with high services inflation suggest we may be in a wage-price spiral.

The biggest contributors to the changes in headline inflation between June and July were:

Transport -0.11 percentage points

Restaurants and Hotels 0.06 percentage points

Food and Non-Alcoholic Beverages 0.02 percentage points

Recreation and Culture -0.02 percentage points

We can look in more detail at the contributions of the different sectors to overall inflation in figure 1 below, with the old inflation dropping-out of the annual figure (July-August 2024) shown in blue and the new monthly inflation dropping in (July-August 2025) shown in brown. The overall effect is the sum of the two and is shown as the burgundy line. Overall, if we focus on the brown new inflation, we have 9 positive contributions and just 2 negatives. The blue dropouts were positive in just 1 sector, and negative in 9. The constant headline inflation results from the balance of drop-outs and drop-ins across 11 out of 12 expenditure types. This is an unusual symmetry, as there is usually more heterogeneity in terms of the balance across. We see no expenditure type where the blue and brown bars have the same sign.

Extreme Items

Out of over 700 types of goods and services sampled by the ONS, there is a great diversity in how their prices behave. Each month some go up, and some go down. Looking at the extremes, for this month, the top ten items with the highest month on month (MoM) inflation are:

| Table 1: Top ten items for MoM inflation (%), August 2025 | |

| INTERNET BLU-RAY DISC | 39.93 |

| EBOOKS | 34.61 |

| MUSIC DOWNLOADS | 18.53 |

| LIGHT BULB SMART/WIFI | 16.80 |

| FRUIT JUICES, FROM CONCENTRATE | 14.69 |

| ACTION CAMERA | 14.12 |

| GIRLS JACKET (5-13 YEARS) | 13.23 |

| EURO TUNNEL FARES | 12.39 |

| CD ALBUM (TOP 40) | 12.11 |

| INFANT’S TROUSERS 0-2 YEARS | 9.71 |

The ten items with the highest negative inflation this month are shown in Table 2.

| Table 2: Bottom ten items for MoM inflation (%), August 2025 | |

| ELECTRIC RAZOR | -8.70 |

| PRE-RECORDED DVD (FILM) | -9.09 |

| INTERNET DVDS | -9.26 |

| MENS SHORTS NOT SWIMWEAR | -9.62 |

| HOTEL ADVANCE PRICE 1 NIGHT | -10.23 |

| COMPUTER GAME 3 | -10.55 |

| TOOTHBRUSH | -11.71 |

| COMPUTER GAME 1 | -16.06 |

| ROADSIDE RECOVERY SERVICE | -27.26 |

| COMPUTER GAME 2 | -29.25 |

August saw Blu Ray and music downloads soar, whilst those who still use “pre-recorded” DVDs enjoyed a welcome drop. Not a bad month for a car breakdown either.

In both these tables we look at how much the item price-index for this month has increased since the previous month, expressed as a percentage. These calculations were made by my former PhD student at Cardiff University, Dr. Yang Li, who has just taken up a post as Lecturer in International Business, Guangzhou College of Commerce and so can restart his much missed contribution to make this “Extreme items” commentary possible.

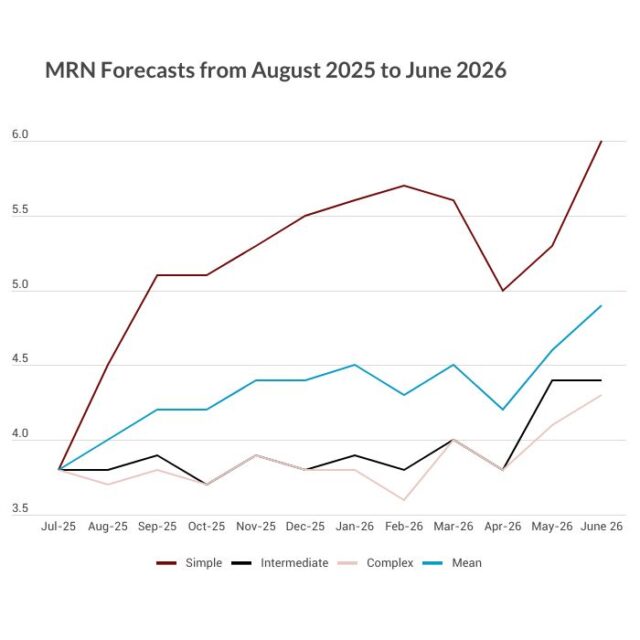

Looking forward through 2025 into 2026

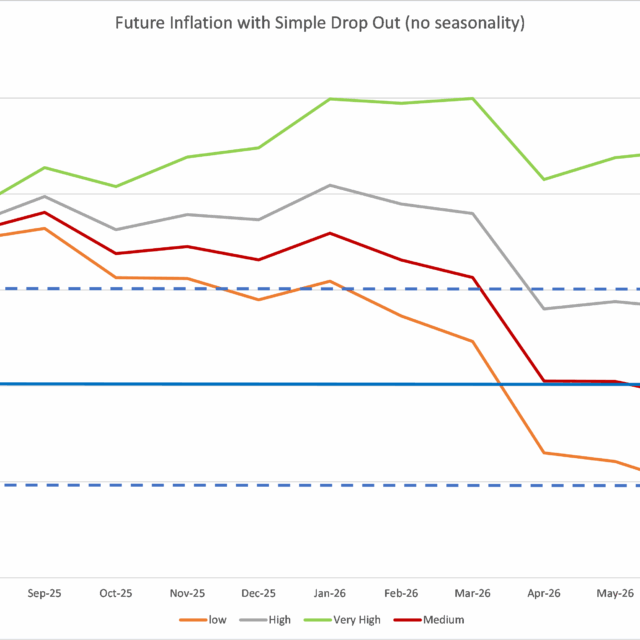

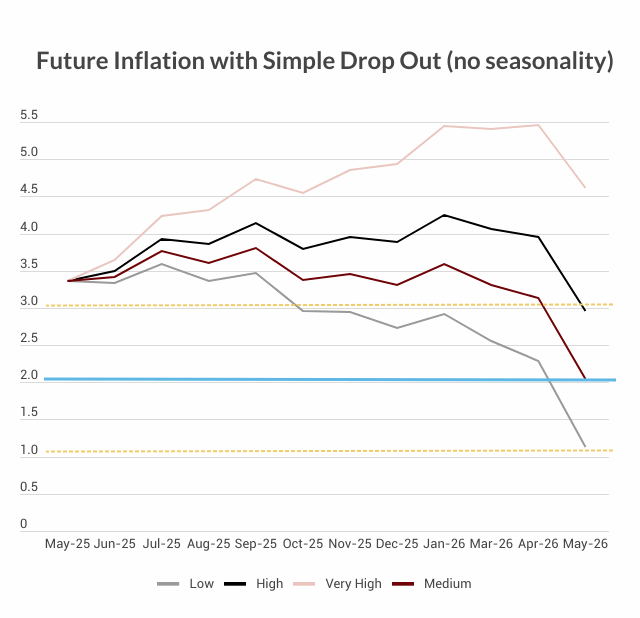

We can look ahead over the next 12 months to see how inflation might evolve as the recent inflation “drops out” as we move forward month by month. Each month, the new inflation enters the annual figure and the old inflation from the same month in the previous year “drops out”. We depict the following scenarios for future inflation dropping in:

- The “low” scenario assumes inflation each month is equivalent to 1 per cent per annum (0.08 per cent per calendar month).

- The “medium” scenario assumes that the new inflation each month is equivalent to what would give us 2 per cent per annum or 0.17 per cent per calendar month – which is both the Bank of England’s target and the long-run average for the last 25 years.

- The “high” scenario assumes that the new inflation each month is equivalent to 3 per cent per annum (0.25 per cent per calendar month).

- The “very high” scenario assumes that the new inflation each month is equivalent to 5 per cent per annum (0.4 per cent per calendar month). This reflects the inflationary experience of the United Kingdom in 1988-1992 (when mean monthly inflation was 0.45 per cent).

We think that inflation is most likely to come in the “high to medium” range. This would indicate that inflation in September might rise to 4.0 per cent (medium and high) or slightly more to 4.2 per cent (very high). Under all three scenarios (medium, high and very high), inflation remains above 3 per cent until April 2026. Even with the (highly unlikely) low scenario, inflation remains above 3 percent for the rest of 2025.

This forecast assumes that geopolitical tensions do not deteriorate. I have commented on these in previous blogs. The direct effects of Tariffs on UK inflation would appear to be minor, although fallout from the US-China trade war might have adverse effects on particular supply chains in Britain.

For further analysis of current and future prospects for inflation in the United Kingdom see:

How does Inflation affect the economy when interest rates are near zero? Economics Observatory.

How are rising energy prices affecting the UK economy? Economic Observatory.